Will my last payroll of the calendar year be included in this year’s W-2?

Form W-2 contains all payroll data for the calendar year. This payroll data is based on pay date, the pay period has no impact.

TIP:

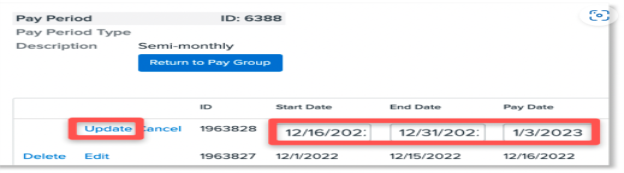

To ensure the form includes the calendar year of your last payroll, the pay date must be set on or before 12/31 of the current year.

To update your pay date in Namely Payroll:

-

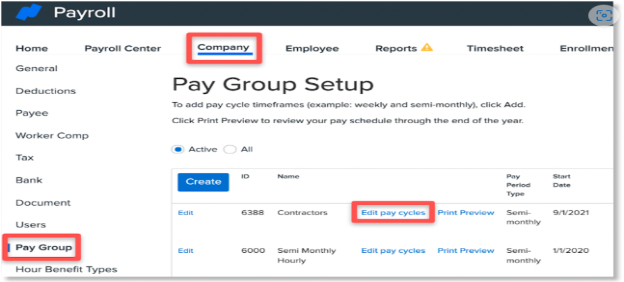

Go to Company > Pay Group > Edit Pay Cycles next to your pay group.

-

On the next screen, click Edit next to the impacted pay cycle(s).

-

Update the pay period details, click Update.

TIP:

Unable to edit your pay cycles or select your desired pay date? Submit a case in the Help Community for additional assistance.