Why am I receiving a screen asking me to fill out tax information when running payroll?

This screen is alerting you to the fact that you have incomplete tax information on your Company Tax page.

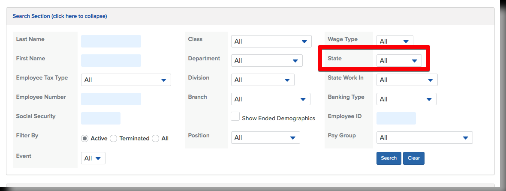

You can determine the employee(s) triggering this screen by leveraging the Employee Search in Namely Payroll. Leave all search parameters blank and select the state noted from the State drop down menu.

The search engine will pull a list of employees coded to the state you select.

This is most commonly seen when there is a new hire living or working in a state you have not previously processed payroll in. Entering the employee's lived and worked in states on their tax profile will add necessary taxes to your company taxpage, however, Namely Payroll requires a valid rate, tax ID and frequency in order to run payroll.

If you do not yet have the tax ID for the new tax jurisdiction, you may use the Applied For status. These resources will guide you on how to leverage the Applied For status, and will provide guidance on how to register for new taxes in general:

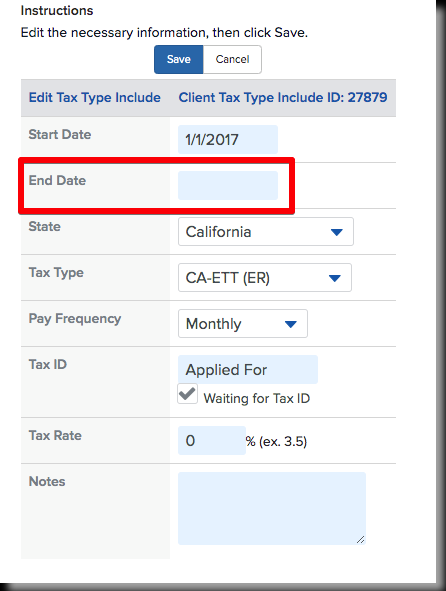

If you do not have any employees requiring withholding for the taxes noted, you may add an end date to the tax. Click Company and then Tax, and finally Edit next to the tax in question. You can add an end date to the tax from this screen.