Where can I review my pay type codes?

There are four ways to review a list of your pay type codes. If you need to have a list of your pay types in a .CSV format, refer to Method 4.

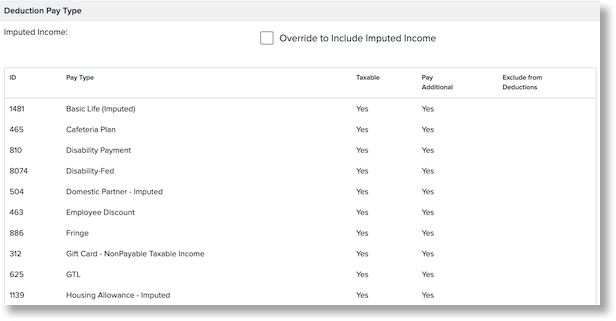

Method 1: Under Company > Deductions

-

In Namely Payroll, click Company > Deductions.

-

Next to any deduction record, click Edit.

-

Scroll down to the section labeled Deduction Pay Typeto view the list of pay type codes currently configured for your payroll site.

TIP:

The Deduction Pay Type section does not display all pay types available in your system. It excludes non-taxable earnings and taxable earnings that do not have the exclude from % based deductions functionality. To view the complete list of your pay types, refer to the methods below.

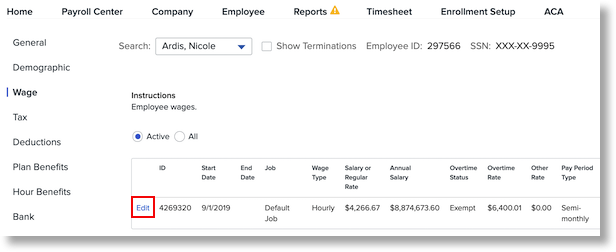

Method 2: Under an employee Wage record

-

In Namely Payroll, go to the Employee tab, then search and go to any employee profile.

-

Click the Wage tab.

-

Next to the wage record, click Edit.

-

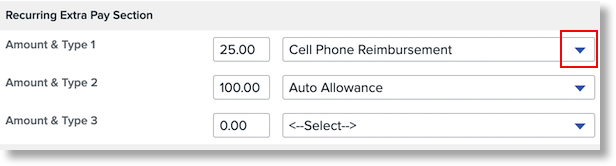

Scroll down to the Recurring Extra Pay section.

-

Click the dropdown to view a full list of your earnings codes.

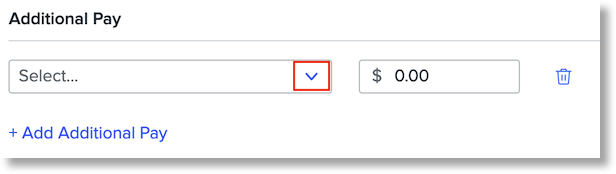

Method 3: In Step 1 of Payroll

-

In Namely Payroll, navigate to the Payroll Center, then click Run Payroll or Continue next to one of your pay cycles.

-

Click the

Edit Check icon next to an employee.

Edit Check icon next to an employee.

-

Under the Additional Pay section, click the dropdown to view a list of pay type codes.

Method 4: Reach out to your Service Pod (.CSV format only)

For a full list of your pay types in a .xlsx format, submit a case in the Help Community.

-

Product Name: Payroll

-

Product Feature: Company Setup

-

Function: General Questions