Where can I find a list of employees who have not consented to electronic delivery for tax forms (e.g., W-2 and 1095)?

In accordance with IRS regulations, employers must mail paper copies of applicable tax forms postmarked by January 31st whenever an employee has opted not to receive an electronic form, no longer has access to the system, or has failed to make their selection.

To help you identify which employees will need paper forms mailed to them, the W-2 & 1095-C Consent Status Report is available in Namely Payroll under Reports > Date Range.

-

Employees who have Paper or a blank listed under a certain form have not consented to receive that form electronically.

-

If you would like to encourage your employees to go into the system and complete the Electronic Delivery Consent Form, please see the following article: How do I sign up for electronic delivery of my payroll documents (e.g., W-2 and 1095)?

Notes:

-

Namely does not print or distribute paper copies of tax forms. For more information on printing, please refer to the following article: Does Namely offer a W-2 or 1099 printing service?

-

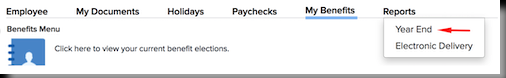

Terminated employees who chose to receive digital copies will still be able to log into Namely Payroll using their personal email and existing password. To locate their forms, they can go to Reports > Year End.