Updated Federal Withholding Fields

Updates to the federal withholding fields on the employee tax page to match the 2020 Federal Form W-4.

OVERVIEW

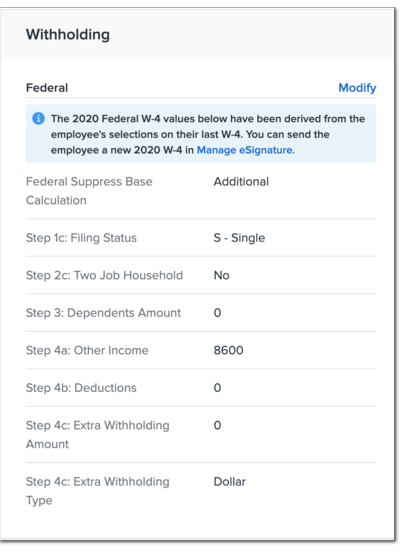

We’ve updated the federal withholding fields on the employee tax page in Payroll to match the order and names of their corresponding boxes in the 2020 Federal Form W-4.

UPDATED WITHHOLDING FIELDS

If you use Namely’s Tax Unification feature, changes to an employee’s W-4 automatically flow into Payroll whenever they’re submitted via Manage eSignature or during onboarding. However, for any manual changes, you can now easily copy withholding information from an employee’s W-4 onto their tax profile.

New Fields and Updated Behavior

-

The new field Step 2c: Two Job Household allows employees to indicate whether they are working multiple jobs.

-

Dependent information, other income, and deductions are now entered as dollar amounts. (Allowances no longer exist on the W-4 form.)