State Unemployment Insurance Wage Transfer

OVERVIEW

State Unemployment Tax Reciprocity Agreements ensure that taxes are not overpaid when employees move between reciprocal states. We’ve enhanced Namely Payroll to recognize states with reciprocity agreements to ensure employer taxable wages are capped appropriately for State Unemployment Insurance

There are four states where State Unemployment Tax Reciprocity is not applied in Namely. Louisiana, Minnesota, and Montana do not allow wages from other states to be applied. Indiana requires approval prior to applying other state-taxable wages, see the instructions here to apply for the credit.

What is Changing

Tax Reciprocity Agreements vary between states, and will result in a lower taxable wage for the affected employee. With the implementation of these agreements, employers will pay the proper amount of taxes for unemployment insurance each time payroll is processed, instead of reconciling the difference when your company’s taxes are filed.

Effective immediately, Namely Payroll will recognize these agreements and calculate the proper amount of taxes when you process your payroll.

States that require additional forms or information

The states listed below require additional information or forms to be filed for each quarter when prior state wages were used. You are responsible for filling out the forms and then mailing them or sending additional information to each state. If you have employees that have transferred to one of the states listed below, complete the required forms or provide the state with the information they require each quarter.

-

Massachusetts – Complete this form and email it to the state.

-

Washington D.C. – Provide the state with the information required. See instructions here.

-

North Carolina – Supply the NC Dept of Employer Services with proof that the correct tax was paid to the other state. See instructions here.

-

New Mexico – Complete this form and email it to the state.

Reporting

The tax reports below will reflect the new reciprocity agreements.

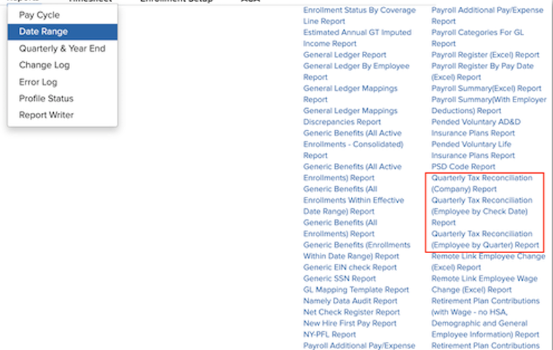

Beginning in Q1 2022, the Quarterly Tax Reconciliation (Company) Report, Quarterly Tax Reconciliation (Employee by Check Date) Report, and Quarterly Tax Reconciliation (Employee by Quarter) Report will also accurately reflect your employees’ taxable wages. These reports can be accessed by going to Reports > Date Range in Namely Payroll.

The three reports mentioned above will not reflect the updated taxable wages provided by the revised calculations until Q1 2022.