Simplify Retirement Deductions with Cross-Deduction Matching

At Namely, we are dedicated to continuously enhancing your HR and payroll experience. We understand that managing retirement deductions can be a complex and time-consuming task, which is why we're excited to introduce our latest feature: Cross-Deduction Matching. This powerful tool has been developed based on valuable feedback from our clients, and it's designed to streamline the process of managing employer matches across multiple retirement deductions within the same plan group. In this knowledge article, we will walk you through the benefits of Cross-Deduction Matching and how to make the most of it.

What is Cross-Deduction Matching?

Cross-Deduction Matching is a feature that automates the allocation and capping of employer matches across various retirement deductions. It eliminates the need for manual monitoring and overrides, making your HR tasks more efficient and accurate.

Key Highlights

-

Automated Deduction Matching: Cross-Deduction Matching automatically applies and caps employer matches across multiple retirement deductions, saving you time and effort.

-

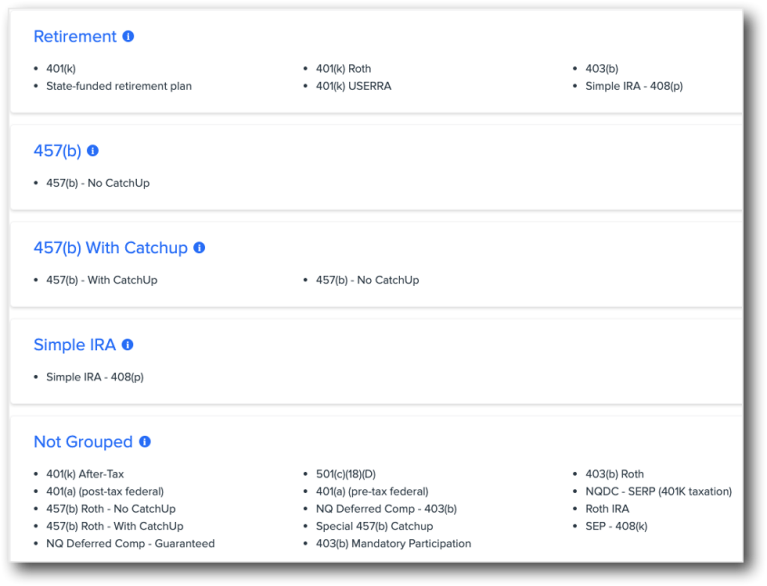

Seamless Integration: To make the most of this feature, ensure that the deductions are within the same retirement plan group. Please note that Cross-Deduction Matching is currently unavailable for deduction types in the Not Grouped category.

-

Deduction Priority Order: The feature's deduction priority order is predetermined and cannot be changed. For instance, within the Retirement group, employer matches will be allocated first to deductions with type 401(k), and any remaining amount will be applied to deductions with type 401(k) Roth. You can find the deduction priority order in the banner at the top of the Company > Deductions page.

-

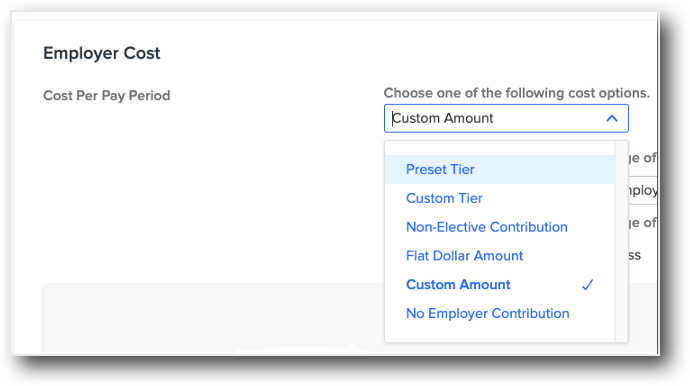

Matching Configuration: To enable Cross-Deduction Matching, ensure that the Employer Match is configured with the same option across deductions (e.g., Custom Amount, Preset Tier, Custom Tier, etc.).

-

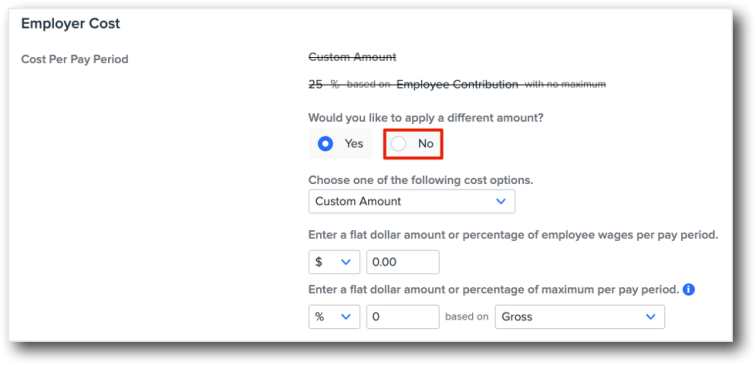

Overrides: Remove any previous employee-level overrides and set them back to the company-level default for the feature to work correctly. You can achieve this by editing the employee-level deduction and selecting No under Would you like to apply a different amount?

-

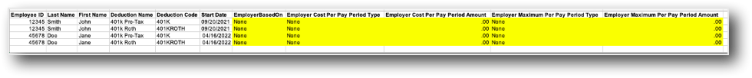

Bulk Overrides Removal: If you have a significant number of manual overrides (more than 10), you can provide a Deduction Modify import file to our customer service team. To generate the required information, navigate to Namely Payroll > Reports > Date Range > Microsoft Excel Reports Column and run the Employee Deduction Report. Filter the report to your applicable deductions, and retain the following columns:

-

Employee ID

-

Last Name

-

First Name

-

Deduction Name

-

Deduction Code

-

Start Date

-

Employer Based On

-

Data default set to None

-

-

Employer Cost Per Pay Period Type

-

Data default set to None

-

-

Employer Cost Per Pay Period Amount

-

Data default set to 0.00

-

-

Employer Maximum Per Pay Period Type

-

Data default set to None

-

-

Employer Maximum Per Pay Period Amount

-

Data default set to 0.00

-

-

Once you provide the import file to our customer service team and the overrides are reset, Cross-Deduction Matching will work seamlessly for your organization.

With Cross-Deduction Matching, managing retirement deductions has never been easier. This feature was developed with your needs in mind and is designed to save you time and reduce the margin for error. As you work through the process, please remember we are here and committed to delivering HR solutions that empower you and your organization.

For additional information or support, please explore our Help Center or submit a case in ClientSpace.