Setting up Company Matches for Charitable Donations

This article explains how you can set up company matches for donations.

Namely has chosen to match employee donations to the Black Visions Collective, The Know Your Rights Camp, The NAACP Legal Defense Fund the National Health Law Program, and the Equal Justice Initiative as part of our commitment to diversity, inclusion and equality. If you're exploring similar efforts, you can manage the contributions and employer match directly in Namely Payroll.

Once you have set up a deduction for the purpose of a charitable donation, you can then add an employer match.

To set up the employer match:

-

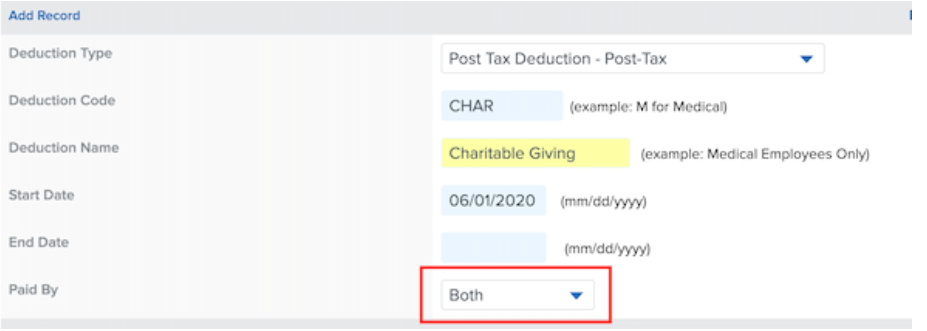

Go to Namely Payroll > Company > Deductions, and Add or Edit the desired deduction.

-

On the deduction, first make sure that Paid By in the Add Record section is set to Both.

-

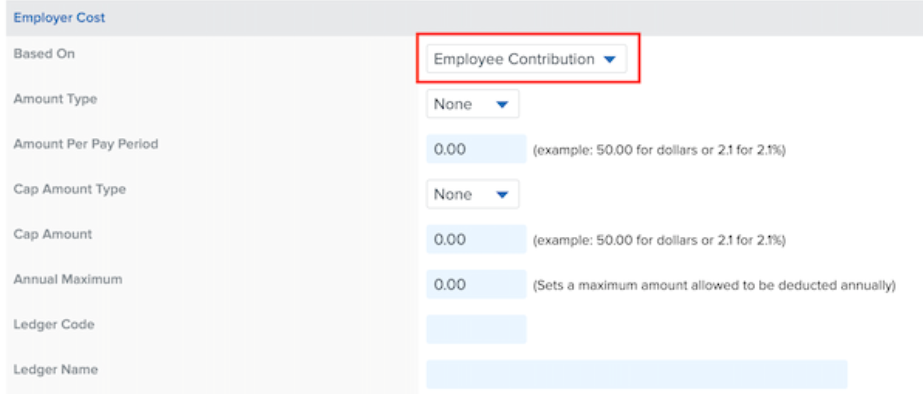

Next, continue to the Employer Cost section, and select Employee Contribution under Based On.

-

Proceed to complete the fields to set up the employer match. Note that you can choose either a Dollar or Percent match under Amount Type.