Seattle Payroll Expense Tax

Seattle has created a new Payroll Expense Tax for certain organizations, beginning January 1, 2021.

BACKGROUND

Beginning on January 1, 2021, the city of Seattle, Washington will impose a Payroll Expense Taxon companies that had $7 million or more in annual payroll for the prior calendar year. The tax rates are determined by annual business revenue and level of employee compensation.

Tax Rates

Companies with an annual payroll of at least $7 million in business revenue in the prior calendar year:

-

0.7% employer-paid tax for employees with annual compensation in the current calendar year between $150,000.00 and $399,999.00.

-

1.7% employer-paid tax for employees with annual compensation of $400,000.00 or more in the current calendar year.

Companies with an annual payroll of at least $100 million in business revenue in the prior calendar year:

-

0.7% employer-paid tax for employees with annual compensation in the current calendar year between $150,000.00 and $399,999.00.

-

1.9% employer-paid tax for employees with annual compensation of $400,000.00 or more in the current calendar year.

Companies with an annual payroll of at least $1 billion in business revenue in the prior calendar year:

-

1.4% employer-paid tax for employees with annual compensation in the current calendar year between $150,000.00 and $399,999.00.

-

2.4% employer-paid tax for employees with annual compensation of $400,000.00 or more in the current calendar year.

Note: The Seattle payroll expense tax does not apply to businesses with less than $7 million in annual payroll or employees under the wage thresholds.

Payroll Expense Requirements

The term “payroll expense” is defined as the “compensation paid in Seattle to employees.” Compensation is considered paid to an employee in Seattle if at least one of the following requirements are met:

-

The employee is “primarily assigned” to work within Seattle, WA.

-

The employee performs 50% or more of their services in Seattle, WA.

-

The employee does not perform 50% or more of their services in any city, but the employee resides in Seattle, WA.

NEXT STEPS

The Seattle Payroll Expense Tax is a business excise tax, not a conventional payroll tax, as a result, we will not be withholding and remitting payments for you.

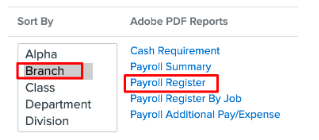

To determine your payroll expense you should run a Payroll Register report by Branch.

FREQUENTLY ASKED QUESTIONS

If my company has less than $7 million in annual business revenue, will my Seattle employees have to pay this tax?

No. The tax is imposed on the business, not the employees.

If my employees make less than $150,000.00 in a calendar year, do they have to pay this tax?

No. The tax is imposed on the business, not the employees.

How is a business’s payroll expense determined?

The payroll expense is determined by the amount of compensation paid in Seattle to employees. In this instance, compensation has the same meaning in regards to payroll expense tax as it does for the Washington State Family and Medical Leave program. Compensation includes all payments for personal services, including commissions and bonuses, and the cash value of all earnings paid in any medium other than cash.

How often is this tax remitted?

The Seattle Payroll Expense tax will be payable and due on January 31, 2022 for tax collected during 2021. The tax will then be due, and payable on a quarterly basis in subsequent years. As of now, this tax is set to expire on December 31, 2040.

Where can I find my tax ID number for the Seattle Payroll Expense Tax?

Your ID number for the Seattle Payroll Expense Tax should be the same number that appears on your Seattle Business License Tax Certificate.