SOC Reporting Requirements

What are SOC codes?

SOC stands for Standard Occupational Classification. It’s a federal coding system that helps government agencies and private businesses compare occupational data.

This data is used by:

-

Government program managers.

-

Industry and labor relations specialists.

-

Students considering career training.

-

Job seekers.

-

Vocational training schools.

-

Employers wishing to set salaries or locate a new business.

Each employee can be classified in one of 867 detailed occupations listed. SOC codes were first developed in 1980, and the current manual was published in 2018. You are encouraged to use the SOC code lookup tool for a listing of the most accurate codes for each employee type. These are the same codes found in the drop-down box found in Namely Payroll> Employee> General Page. These codes are provided by the U.S. Bureau of Labor Statistics.

It is important to note that SOC codes differ from NAICS and Workers Compensation codes.

-

NAICS is the standard used by Federal statistical agencies in classifying business establishments. More information can be found at United States Census Bureau.

-

Workers Compensation codes are 4-digit numerical codes that insurers use to classify employee exposure to risk. The insurance company from which you purchase your WC policy will provide you with the codes based on the type of work your business does and summaries of what jobs employees are responsible for.

SOC codes are transmitted on the quarterly unemployment wage filings. States may access penalties for missing and/or incorrect codes. Please refer to the state websites below for additional state requirements. We recommend that you input a code for all applicable employees to avoid penalties when state requirements change.

As of 8/29/2024:

States where SOC is Required:

-

Alaska

-

Louisiana

-

South Carolina

-

Washington

-

West Virginia

Those states where SOC is optional are:

-

Indiana

-

North Carolina

Please review your applicable employees to ensure that SOC codes have been entered for the above-mentioned states. You can use the Employee Tax Breakdown Report found in Namely Payroll >Reports>Date Range, filtering by work state as SOC codes are required for the applicable states in which state unemployment tax is paid.

Keep in mind that you will need to enter the code for future employees in the required states.

We will automatically include these codes on quarterly tax forms, as long as they are entered into Namely Payroll.

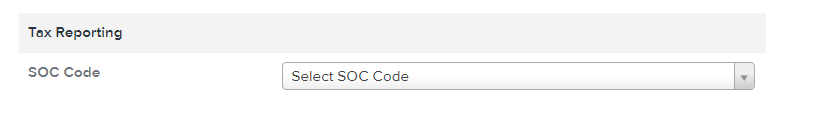

The codes are to be entered in Namely Payroll, Employee, General Page - bottom

Don’t forget to SAVE.

Note: if you are in a state that doesn’t use SOC codes, you will not have the option to add them to the profile of your employee

For additional information, please refer to the Bureau of Labor Statistics and/or the applicable state sites.

Alaska Dept of Labor and Workforce Dev

Hoosiers by the Numbers (powered by IN Dept of Workforce Dev

Louisiana Workforce Commission

NC Dept of Commerce Employment Security

SC Dept of Employment and Workforce

Washington State Employment Security Dept