Quarterly Tax Variance Report

We've released a new report that shows credit and debit tax variances that have been posted to your Payroll account by quarter.

OVERVIEW

We've made it easy for you to to find the source of credits and debits posted to your Payroll account. Our new Tax Variance Report displays any credits or debits you've received due to tax variances by quarter.

ACCESS

To locate the report:

-

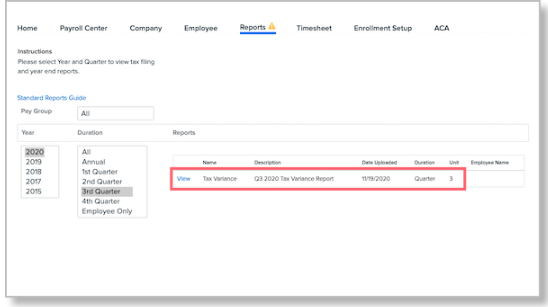

In Payroll, click Reports > Quarterly & Year End.

-

Select either All or a specific quarter.

-

The report's name is Tax Variance and the description will detail the quarter and year for which it was generated.

-

-

Click View to download the report.

VIEWING THE REPORT

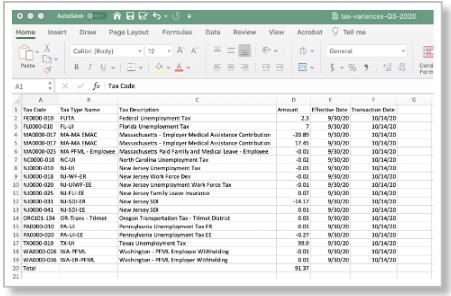

The report will download as a CSV file and include the following columns:

-

Tax Type Name: The abbreviated name of the tax you can find on the Company > Tax page

-

Tax Description: The full name of the tax.

-

Amount: The amount that was either debited or credited to your account (negative amounts are credits).

-

Effective Date: The end of the period the variance applies to—always the last date of the quarter.

-

Transaction Date: The date the funds were either debited or credited to your account.

The cumulative total of all debits and credits will appear in the final row of the report.

-

If there is more than one variance for a single tax (see: MA-MA EMAC above), the amounts will be broken out on the report.

QUARTERLY VARIANCE IN PAYROLL REGISTER

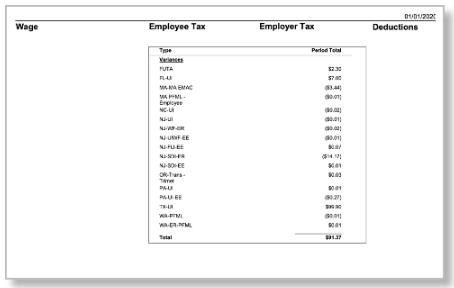

We've also added a line for variances in quarterly Payroll Register reports generated under Reports > Date Range. A new field in the report titled Variances will list all credits and debits made during the quarter.

-

Please note: The Variances section will only appear in quarterly or annual Payroll Register reports—it will not be available in pay cycle Payroll Register reports.

FAQs

Q: Will I be able to see my daily debits/credits?

A: Not at this time. The report will only capture any quarterly variances that are calculated during end of quarter filing.