Quarterly Tax Date Range Report Rename

We've renamed the three quarterly reconciliation tax reports in payroll to give them more intuitive titles.

OVERVIEW

Before submitting quarterly tax filings, it's important to validate all W-2 wages and taxes. The are three specific reports in Namely Payroll that can assist you with this task, but previously, these reports did not have the most intuitive names:

-

Taxes (1 of 3) - Tax Detail Report

-

Taxes (2 of 3) - Employee Tax Summary Report

-

Taxes (3 of 3) - Quarter Reconciliation Report

We've renamed these reports to more accurately reflect the information contained within, as well as how they should be used:

-

Quarterly Tax Reconciliation (Employee by Check Date)

-

Quarterly Tax Reconciliation (Employee by Quarter)

-

Quarterly Tax Reconciliation (Company)

HOW TO ACCESS

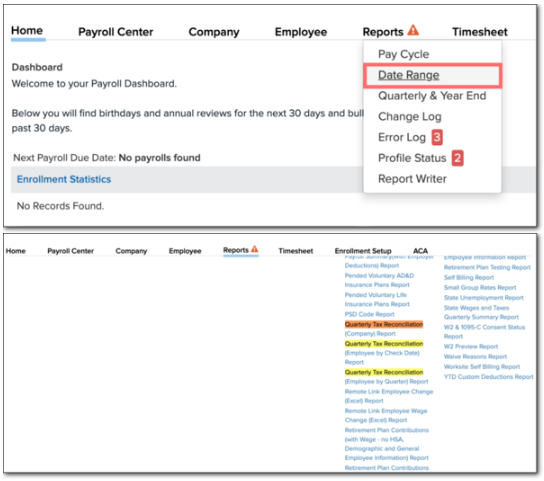

You can access these reports in Payroll by going to Reports > Date Range and searching for Quarterly Tax Reconciliation.

For more information on how to use these reports to validate your quarterly tax filings, use our Quarter End Payroll and Tax Validation Guide.