Moving an employee to a different EIN

OVERVIEW

If you need to move an employee to a different EIN, you'll need to switch their Payroll Company. There are a number of other things to consider when changing an employee's Payroll Company. Refer to the below instructions to ensure a seamless EIN change for your employee.

To move an employee to a different EIN during the same tax year:

HRIS

-

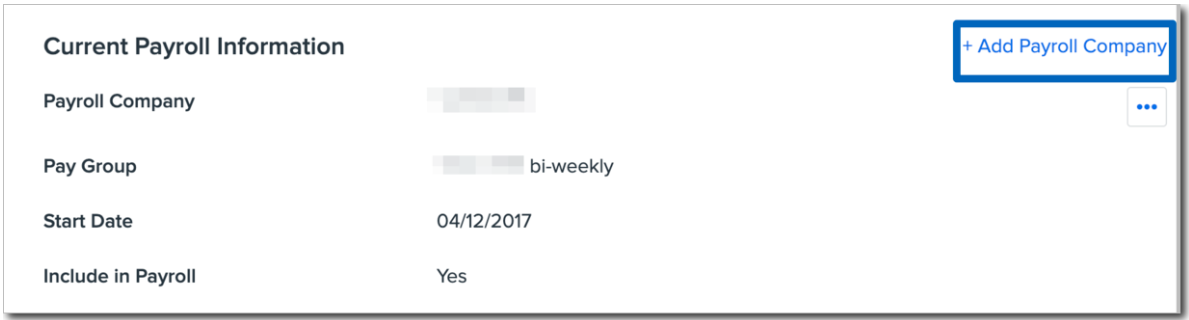

Go to the employee's profile in HRIS, under the General tab, and scroll to the Current Payroll Information.

-

Add the new payroll information and select the new Payroll Company.

-

Start date should be the employee’s original hire date as to not impact file feeds and avoid any demographic errors in the benefits wizard.

-

Include in Payroll must be selected to include an employee in a pay cycle.

-

-

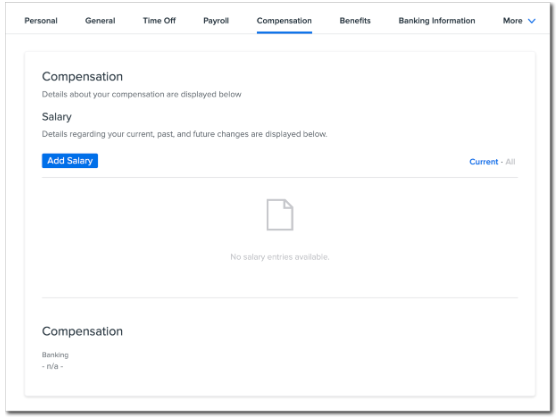

Add a new salary to the employee's Compensation tab under the new Payroll Company.

-

The employee's compensation record should reflect the new EIN. Reference the employees existing compensation record and create a new record to match with the exception of the Payroll Company and effective dates of the new EIN.

-

Enter the Start Date of this wage record as the beginning day of the pay period of the first pay date under the new EIN.

-

End date previous compensation record last day of the pay period for the last pay date under the old EIN.

-

-

Update the demographic information.

-

If your company implemented Org Units, update the employee's Org Units under the new EIN via the Org Units & Teams tab on their profile. Be sure to use the employee’s original hire date as the effective date and end date the pre-existing org unit records.

-

-

Update employee tax information.

-

If applicable, send the employee a new Federal and State W-4 via Manage eSignature. The alternative is to copy over existing tax information. See Step 9 for more details on this. If proceeding with Step 9, this step can be skipped.

-

-

Update the banking information.

-

Navigate to the HRIS employee profile and select the Banking Information tab.

-

Select Update Banking under the header for the new EIN the employee is assigned to and Duplicate Existing Bank Account.

-

-

Add a Departure Date to end-date the old EIN.

-

If the employee is no longer associated with the old EIN, end date the Pay Group associated with the previous EIN using the last day of the pay period for the last pay date under old EIN.

-

Uncheck the Include In Payroll box and click Save Changes.

-

Payroll

-

If your company has not yet implemented Org Units, assign the employee's Demographics for the new EIN via Manage Payroll.

-

If opting not to send new forms per Step 5 above, navigate to Manage Payroll under the new EIN and select the Employees tab. Select the employee profile and select Tax on the left-hand menu. Enter in the tax selections this employee is subject to (reference his/her profile on the old EIN.)

-

Any Exempt Taxes will need to be exempted again. If the employee is exempt from FUTA/FICA, a new FUTA/FICA exempt form will need to be completed.

-

Any recurring wages and hour benefits will need to be added to the employee's profile in Namely Payroll.

-

Navigate to Manage Payroll under the new EIN and select the Employees tab. Select the employee profile and select Wage on the left-hand menu. Enter the recurring earning amount this employee is subject to (reference his/her profile on the previous EIN.)

-

-

Enter deductions on employee profile for new EIN.

-

Navigate to Manage Payroll under the new EIN and select the Employees tab. Select the employee profile and select Deductions on the left-hand menu. Enter in the payroll deductions this employee is subject to (reference his/her profile on the previous EIN.) Note that benefit related deductions will automatically populate once the employee is re-enrolled in benefits.

-

401k/HSA/FSA/Deductions with calendar year annual limits - please note that the Namely system utilizes year-to-date accumulations based on payrolls processed within a Payroll site when determining when to automatically halt a deduction when calendar year limits are being met. As the deductions being set up on the employee profile under the new EIN will have no link to the year-to-date accumulations from payrolls processed under the old EIN, you will need to take note of the year-to-date contribution amount already processed in the old EIN and determine the remaining balance to manually enter into the Annual EE Maximum field of the deduction. It is the client's responsibility to remove the annual maximums in the upcoming year.

-

-

Benefits (FOR BENEFITS RECIPIENTS ONLY)

-

Assign Class using the employee's original hire date.

-

If your company has implemented Org Units, navigate to the HRIS employee profile and select the General tab, scroll down to the section Benefits Class, and click Manage to assign the employee class in the new EIN. Confirm that the Start date of this class assignment matches the original hire date. You can reference an employee’s existing class assignment under the previous EIN on this page.

-

End date previous class assignment.

-

If your company has not yet implemented Org Units, navigate to Namely Payroll to update their class assignment.

-

-

Employees must re-enroll in Benefits within the new Payroll Company.

-

Please note that in order to populate employee plan election information in their new profile, you will have to do so as an administrator using the Administrator Change Life Event. You can reference an employee’s existing elections under the old EIN by referencing his/her profile on the old EIN under Plan Benefits.

-

-

Terminate Employee Benefits for removal of duplicate Carrier Feed submission (if applicable).

-

Navigate to Manage Payroll under the old EIN and select the Employees tab. Select the employee profile and select General on the left-hand menu. Enter in Transfer EIN as the Termination Reason and click Terminate Plan.

-

If an employee moves back to a previous EIN, please remember to remove the termination reason and reinstate the benefits.

-

THINGS TO CONSIDER

Carrier Feeds

-

To avoid a gap in coverage, new employees should be enrolled and set up with the new EIN before the next EDI file is sent.

Payroll

-

Employees' wage base limits for taxes (i.e., FUTA, SUI, and FICA) will restart if EINs are switched in the middle of the year.