Massachusetts Paid Family and Medical Leave Configuration

We've updated the MA PFML configuration on to be more intuitive!

OVERVIEW

We have added flexibility to the Massachusetts Paid Family and Medical Leave tax in our, allowing for a number of different configurations. With this enhancement, you'll be able to control your company's contribution selection right on the company tax page.

Use the article Massachusetts Paid Family and Medical Leave Tax to stay updated on current rates and changes to the tax.

What's New

We've made the setup more precise for employee configuration by giving you the opportunity to select the size of your company right on the page.

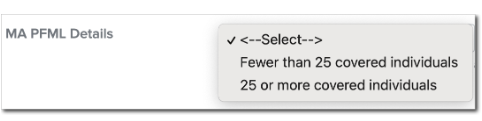

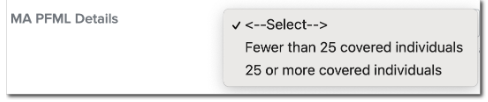

In the MA PFML Details dropdown, you can select either

-

Fewer than 25 covered individuals

-

25 or more covered individuals

Be sure to choose the selection that reflects you and your company.

We've also made it easier to tell us whether you as a company, want to pay the employee portion of the tax. Simply click the checkbox next to Map employee withholdings for MA PFML to the employer (we wish to pay it) and it will automatically map your employee withholdings to your company's.

TIP

This feature is unavailable for the MA PFML Employer as it will automatically select and map over the information from the MA PFML Employee configuration.