MA PFML Private Plans with Employee Contributions

Use this as a guide to set up MA PFML private plans with deducting allowable employee contributions.

Process

If you have a MA PFML Private Plan and want to deduct the allowable employee contributions, you will need to follow the steps below. Since contributions are a percentage of an employee’s taxable wages and Namely Payroll’s deduction setup can only accommodate a percentage of the employee’s gross or net pay, not taxable wages.

Set Up as Tax

You should use this setup if you plan on deducting the full amount allowable (this amount will change each year based on the rates set by the state).

MA PFML employee contributions are allowed for a private plan but must not cost your workers more than they would be required to contribute to the state plan under the paid leave law. The allowable rates and wage base will change each year. Since this is set up as a Company Tax, the system will automatically be updated each year to reflect the proper rates and wage base.

With this setup, the employee portion of the taxes will be withheld based on a percent of the taxable wages up to the wage base. The amounts collected from employees will not be collected from you. You should use the collected tax amounts from the employees to offset your MA PFML private plan premiums. Tax returns will not be filed as long as you have the Applied For status as the Tax ID.

Tip:

You may receive automated messages advising them they have a missing tax ID for MA PFML; those should be disregarded.

Set up as a Deduction

You should use this setup if you plan on deducting less than the full allowable amount (this amount will change each year based on the rates set by the state).

Tip:

Correct setup is essential for the tax to be withdrawn as expected.

Prerequisites

You must have a MA PFML private plan approved by the agency.

Procedure for Tax Setup

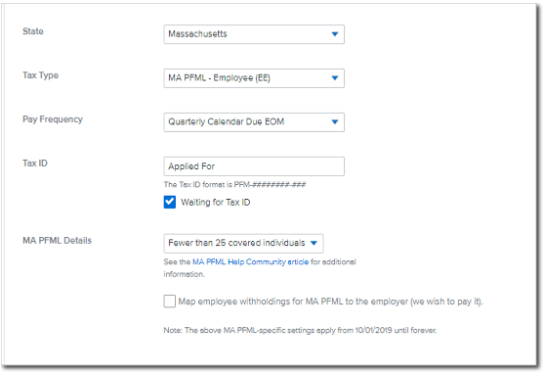

-

Set up your MA PFML in Namely Payroll for the employee portion of the tax only.

-

This can be done by selecting Fewer than 25 employees.

-

-

Enter the Tax ID as Applied for by choosing the Waiting for tax ID checkbox.

-

You are responsible for leaving the Tax ID in the Applied for status. The Applied for status will ensure that the employee deductions are not collected by Namely and the tax filings are not filed.

-

-

Log a case in the Help Community under Payroll > Tax Services > Tax Profile Audit stating that you have a private MA PFML plan and want to collect the employee portion of the taxes (premiums).

Procedure for Deduction Code Setup

To ensure correct taxation, the deduction code for MA PFML Private plan must be used, and the deduction code must be mapped to box 14 on the W2. Follow the steps below to complete this.

-

In Namely Payroll go to Company > Deduction > Add Deduction.

-

Once the deduction is added on the company level, you will need to add the deduction to all applicable employees.

Tip:

You should calculate the percentage and set a maximum per year based on the current years wage base for MA PFML.

-

Log a case in the Help Community under Payroll > Tax Services > Tax Profile Audit stating that you have a private MA PFML plan. Be sure to note that a deduction should be set up to collect from the employees.