Is 401(k) deducted from Federal Paid Sick and Medical Leave earnings?

Yes- 401(k) will be deducted from Federal Paid Sick Leave and Federal Paid Medical Leave earnings.

If you would like to ensure that 401(k) deductions do not come out of these earnings:

-

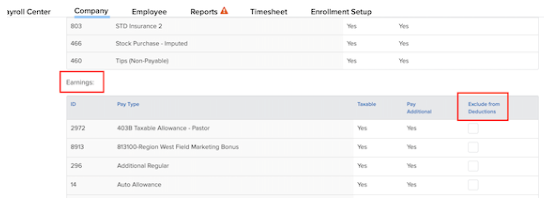

Navigate to Namely Payroll > Company > Deductions.

-

Click Edit next to the appropriate 401(k) deduction code.

-

Be sure to follow this process for all 401(k) deductions- e.g., Traditional, Roth, Loan.

-

-

Scroll to the Earnings section, and click the box for Exclude from Deduction next to any earning types (in this case, the Paid Sick or Paid Medical leave earning types) which you would like to exclude from the system's 401(k) contribution calculation.

Note:

this process is only applicable on the company level. You cannot exclude certain earnings from 401(k) deductions for particular employees.