Indiana County Taxation Changes

This article explains the rules and necessary steps when an Indiana employee moves to a different county mid-year.

BACKGROUND

Employees are charged local county taxes based on where they live in Indiana. The following rules apply if an employee lives in Indiana and moves to a different county mid-year:

-

Employees are taxed for the county that they previously lived in for the remainder of the calendar year.

-

Employees are taxed for their new county on January 1st of the following calendar year.

Example

If an employee moves from Dekalb County to Benton County on June 15, 2021, they will be deducted for Dekalb County taxes until December 31, 2021. On January 1, 2022, the employee will be deducted for Benton County taxes.

NEXT STEPS

When the employee relocates to a different county, update your employee’s tax profile in Namely Payroll to ensure proper taxation.

-

In Namely Payroll, click Employee.

-

Go to the employee’s tax profile > Tax.

-

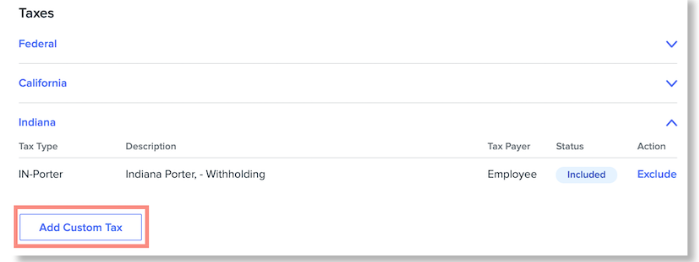

Scroll down to the Taxes section > Indiana > Add Custom Tax.

-

Add the previous county’s Tax Type.

-

Exclude the current county tax for your employee until January 1st of the following calendar year.

Tip:

We are currently working on an automated process for this change and will provide updates as soon as it's available!

Example

In the example mentioned above, you'd want to exclude the Benton County Tax on June 15, 2021, and select Add Custom Tax for Dekalb County. The employee will be taxed this way until December 31, 2021. On January 1, 2022, remove the employee's Dekalb County custom tax, and the exclusion of the Benton County tax.

FREQUENTLY ASKED QUESTIONS

Can Namely make these changes on our behalf?

These changes will need to be made directly on the tax profile of impacted employees. Namely can assist with the taxation changes but keep in mind that Namely does not provide legal, accounting, or tax advice. Please consult with professional counsel for any tax, accounting, or legal questions.

What are the ramifications if we forget to make these changes for an employee?

If an employee is deducted the incorrect amount of county taxes during the year they moved, the difference in tax rates will be reconciled when the employee files their personal tax returns.

If an employee is deducted the incorrect county taxes for the remainder of the year in which they moved, taxes underpaid or overpaid resulting from a difference in tax rates will be reconciled when the employee files their personal tax returns. Penalties and interests are not standard practice for localities; however, each locality operates independently so there is no conformity in deciding penalties and interests.

If an employee moves from Indiana to another state, do these changes apply?

No, if an employee moves from Indiana to another state, they will not be deducted any Indiana county taxes when they move.

If an employee moves to Indiana from another state, do these changes apply?

No, if an employee moves to Indiana from another state, their current county tax will be deducted.