How to calculate 401k Gross Ups

How to calculate 401k gross-ups for employees looking to contribute their entire Net Pay to reach the yearly limit.

OVERVIEW

Calculate and adjust an employee 401k Gross-Up within a Pay Cycle in the Payroll Center.

To start, review the applicable employee's past pay cycle to determine the usual 401k amount and their normal Net Pay amount.

-

You can do this by going to their profile in Namely Payroll > Pay History and viewing their last paycheck. If there is already a YTD amount for the 401k, be aware of the remaining balance allowed (Note: Catchup amount is part of the remaining balance for employees 50 and over).

BY PAY CYCLE

-

After confirming the new amount, go to your Payroll Center and select the upcoming pay cycle.

-

Go to Step Two of the pay cycle by selecting Save & Continue at the bottom of the screen.

-

Find the applicable employee's name and click the pencil icon next to their name under Actions.

-

Scroll down to Deductions and enter the full amount of the net pay in the Employee Amount box.

-

The Employee Amount Type will need to be set to $.

-

-

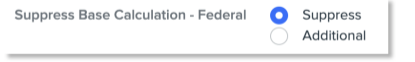

Scroll down to Withholding and Tax and select the Suppress option to suppress Federal and State.

-

Click Save Changes > Calculate Payroll.

-

Verify the net pay is zero.