Garnishments Based on Disposable Income

The Namely Payroll system can automatically calculate disposable income for percentage-based garnishments with deduction types of Garnishment or Continuing Garnishment.

HOW IT WORKS

Employee Deductions

-

Navigate to the Deductions tab > Add Deduction within the employee’s profile in Namely Payroll.

-

Select the applicable garnishment deduction from the Company Deductions dropdown.

-

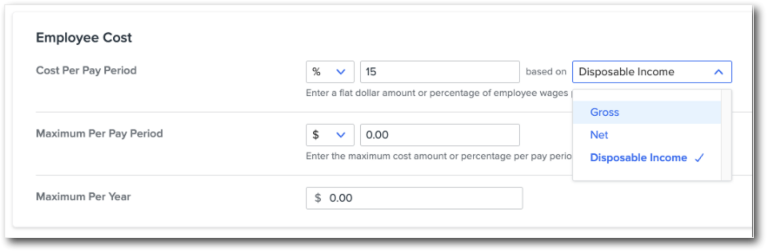

Select the percentage icon in the first Cost Per Pay Period dropdown within the Employee Cost section.

-

Enter the percentage to garnish and select based on Disposable Income from the dropdown.

Company Deductions

-

Navigate to Company > Deductions > Add Deductions in Namely Payroll.

-

Select either Garnishment or Continuing Garnishment.

-

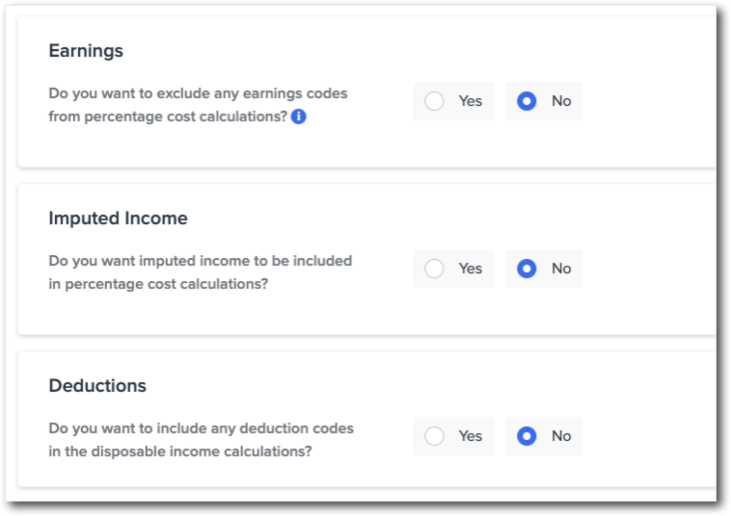

From here, you can choose to exclude earnings from percentage cost calculations and include deductions in the disposable income calculation as needed.

-

All earnings are automatically included, and all deductions are automatically excluded.

-

ADDITIONAL INFORMATION:

-

Disposable Earnings are defined as the amount of earnings left after legally required deductions are made.

-

Examples: Federal, state, and local taxes; Employee-Paid Social Security, Medicare, and State Unemployment Insurance tax; and any withholdings for employee retirement systems required by law

-

-

The system will take all applicable taxes into the disposable income calculation.

-

The system will exclude any earnings and include any deductions configured on the company level deduction setup page.

-

The disposable income calculation is based on the federal wage garnishment law as noted in Title III of the Consumer Credit Protection Act (CCPA) and does not account for differences in state wage garnishment laws.

-

If a state wage garnishment law differs from Title III, the law resulting in the lower amount of earnings being garnished must be observed. If you have questions regarding specific state wage garnishment laws, please consult a tax advisor.

-

In the case of multiple withholding orders, the system will treat all existing Child Support, Tax Levy, and Garnishment deductions as having priority over the new garnishment order in the disposable income calculation.

DISPOSABLE INCOME CALCULATION CHART

The chart below is based on federal law and can be referenced when calculating disposable income. A 25% maximum can be withheld across multiple withholding orders.

|

Based on the $7.25 per hour federal minimum wage, if payment is: |

And the disposable earnings are: |

This amount may be garnished for a consumer debt: |

|---|---|---|

|

Weekly |

$217.50 or less |

None |

|

More than $217.50, but less than $290 |

Amount above $217.50 |

|

|

$290.00 or more |

Maximum 25% |

|

|

Biweekly |

$435.00 or less |

None |

|

More than $435.00, but less than $580.00 |

Amount above $435 |

|

|

$580.00 or more |

Maximum 25% |

|

|

Semimonthly |

$471.25 or less |

None |

|

More than $471.25, but less than $628.33 |

Amount above $471.25 |

|

|

$628.33 or more |

Maximum 25% |

|

|

Monthly |

$942.50 or less |

None |

|

More than $942.50, but less than $1,256.66 |

Amount above $942.50 |

|

|

$1,256.66 or more |

Maximum 25% |