Funding HSA to a Bank Account

This article will explain how an employee may have HSA deductions deposited directly into a direct deposit account.

HSA contributions can be directly deposited into an employee's HSA account if their account is in ABA RTN format (9 digit routing number.) In order for the deposit to be successful and for employee pay data to remain accurate, three items need to be set up for each employee.

These items will need to be reviewed and updated each time an employee updates their HSA contribution to ensure the proper funds reach the employee's account, and their pay stubs and W-2's are accurate.

HSA Deduction

An employee's HSA deduction is updated when Confirmation Reports are approved following a Qualifying Life Event. If you manage your company's HSA elections in Namely's Benefits Administration platform, you can move onto the next section.

If you do not use Namely's Benefits Administration platform to manage HSA, you'll need to set up and maintain the employee's deductions in Namely Payroll.

-

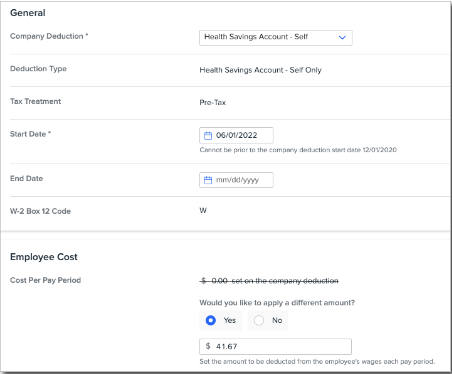

Go to Namely Payroll > the employee's profile > Deductions > Edit (or Add for a new deduction) to set up a Deduction using the Health Savings Account Deduction Type (or HSA Family - if this is an HSA Family plan), including the amount (for both employee and employer, if applicable) to be deducted.

Recurring Wage

Next, you'll want to set up a Recurring Wage for the employee.

-

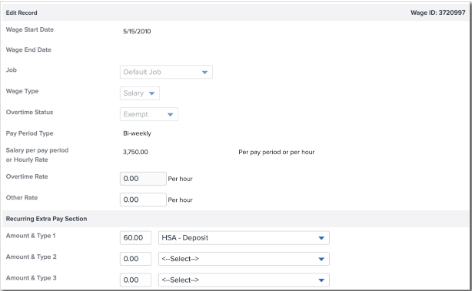

Go to Namely Payroll > the employee's profile > Wage > Edit to set up a Recurring Wage using the HSA - Deposit type, including the full amount to be deposited to the employee.

You'll want to make sure you edit the Recurring Wage any time an employee processes a change to their HSA contribution, whether you manage HSA in Benefits Administration or not. The employee's deduction and the recurring wage must match to ensure that the employee's pay stub and W-2 are correct.

Direct Deposit Account

Next, you'll want to set up a direct deposit account for the employee that captures the total employee + employer HSA contribution.

-

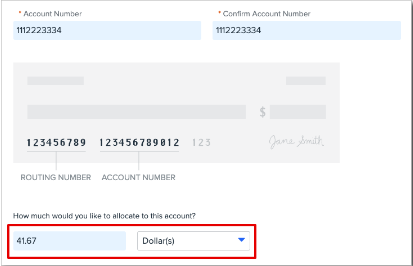

Go to your HRIS portal > the employee's profile > Banking Information

-

Click Add Additional Account.

-

Complete the required fields for the new account and enter how much you would like to allocate to your accounts. For your HSA direct deposit, you should elect the Dollar(s) option, with the amount being the total employee + employer HSA contribution.

-

Click Enroll in Direct Deposit.

The allocation set on the employee's HSA banking page in HRIS is what determines the actual funds that are deposited in the HSA account. This amount should match the employee's deduction and recurring wage and should be reviewed and updated any time an employee makes a change to their contributions.