Employee Guide to Form W-2

FREQUENTLY ASKED QUESTIONS

When will Form W-2 and Form 1099 be available?

Employee Form W-2s and/or Form 1099s will be available electronically within your Namely Payroll site during the third week of January.

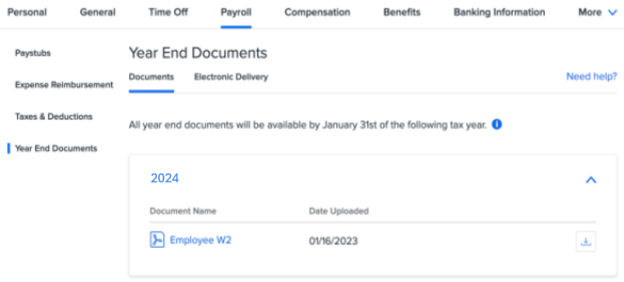

Where can I go in Namely to obtain my Form W-2?

Start from the Home page of your Namely site. Click the “Payroll” tab and click "Year End Documents" located on the left menu.

Tax documents are listed by year, along with the specific document's name and the date it was uploaded. Forms can be viewed in your internet browser by clicking their title, or downloaded by clicking the "Download" icon.

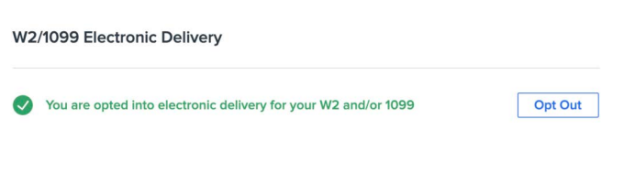

What if I want to receive my Form W-2 via mail rather than online?

If you prefer to receive your Form W-2 via mail, access the Namely landing page > Payroll > Year End Documents > Electronic Delivery. Select “Opt Out”.

I am no longer with my former employer. How do I get access to my Form W-2? Can Namely send it to me? If you are no longer employed by a company that uses Namely, you can still access your previous payroll records, including paystubs and Form W-2s, by logging into www.namelypayroll.com.

You will receive an email from Namely Payroll with the subject line Reset Password in your personal email inbox when your tenure with your prior employer ends. It contains a link that allows you to reset your password, which can be used to log in to Namely Payroll to view your payroll documents. This password reset link expires after 24 hours.

If you are experiencing difficulties logging in to Namely Payroll, please reach out to your previous company’s HR administrator. They will be able to assist you in accessing your account.

Please note: Only your previous employer can grant you access to Namely Payroll. Namely cannot provide access to an employee’s account.

The year-to-date information from my final paycheck of the year does not match the amounts shown on my Form W-2. Why?

Some earnings are considered non-taxable for one or more tax and will reduce the wages that appear in some of the boxes on your Form W-2.

Here are a couple of examples:

-

You received a non-taxable car allowance. The calculation for Box 1, 3, 5 & 16 would be Gross – Non-Taxable Allowance = Taxable Wage in Box

-

Contributions to your company’s 401 (k): For most states, 401(K) contributions are taxable for Social Security and Medicare but exempt from Federal and State withholding. The calculation for Box 1 & 16 would be Gross – 401(K) contribution = Taxable Wage in Box. There is no calculation to reduce Box 3 & 5 because the contribution is taxable.

Why do my taxable wages for federal income tax (Box 1) differ from my taxable wages for FICA (Box 3 and Box 5)?

Some pre-tax deductions reduce taxable income under certain tax buckets. Contributions to 401(k) plans reduce federal wages (Box 1) but not Social Security (Box 3) or Medicare wages (Box 5).

Who do I contact if I don’t receive my Form W-2?

Form W-2s are available on line from your employee profile or through the Namely Mobile App. If you are unable to access those areas, contact your employer to request the form. If your employer is unable to send your form, you can contact the IRS after February 14, at 1-800-829-1040.

What do I do if my Form W-2 is incorrect?

Contact your employer as soon as possible to advise of any discrepancies.

What do I do if my Social Security Number is incorrect on my Form W-2?

Contact your employer as soon as possible to provide the correct information.

When is the additional Medicare tax withheld from wages?

Employers are required to withhold additional Medicare tax from taxable wages in excess of $200,000 in a calendar year (without regard to individual filing status or wages paid by another employer). The additional tax is 0.9% added to the standard 1.45% for a total of 2.35%.

I understand there is a federal unemployment tax (FUTA). I don’t see this tax deducted from my paycheck. Where is the tax deduction?

FUTA is an employer tax that amounts to 6% on the first $7,000 of your earnings. Employees do not contribute to this tax.

What happens if I claim “EXEMPT” on a Form W-4 in 2023 and want to continue in 2024?

You will need to submit a new W-4 each calendar year before February 15 or your employer must withhold based on your last election prior to claiming “Exempt” or treat you as if you had checked the box for Single or Married filing separately if you had not previously completed the form.

I am a nonresident alien student. Do I have to pay FICA and Medicare taxes?

Depending on the type of visa you have you may not be subject to Social Security and Medicare taxes. Please work with your company’s payroll administrator to ensure you are taxed correctly.

I am a current employee who already has a Form W-4 on file. Should I complete a new Form W-4 for 2024?

You are not required to complete a new Form W-4 for 2024 but the IRS recommends that you use the IRS Withholding Estimator to determine if a new Form W-4 is needed. The tool can help avoid having too much or too little tax withheld from your pay for 2024.

What if I am a new employee who does not submit Form W-4 in 2024?

Employers are directed by the IRS to treat new employees who are first paid wages in 2024 and who fail to submit a Form W-4, to be treated as if they had checked the box for Single or Married filing separately.

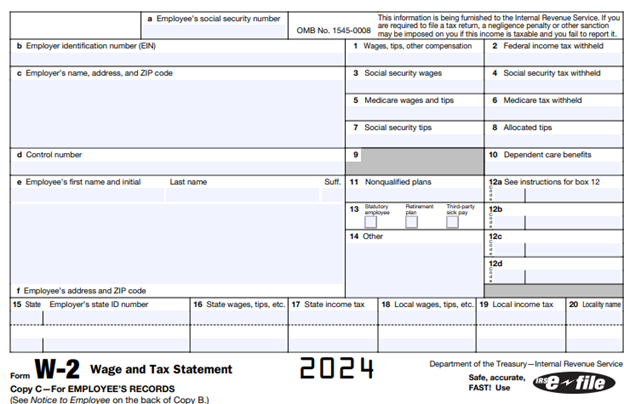

UNDERSTANDING YOUR FORM W-2

What Do All Those Boxes and Codes on My Form W-2 Mean?

Knowing how to read a Form W-2 will help you understand your pay, and help you get a head-start on preparing your taxes. Here’s a line-by-line guide to reading your Form W-2.

Understanding the Numbered Boxes

-

BOX 1: WAGES, TIPS, & OTHER COMPENSATION

Reports the total amount of wages subject to federal income tax.

-

BOX 2: FEDERAL INCOME TAX WITHHELD

Reports the total amount withheld from your paycheck for federal income taxes.

-

BOX 3: SOCIAL SECURITY WAGES

Reports the total amount of wages subject to Social Security tax.

-

BOX 4: SOCIAL SECURITY TAX WITHHELD

Reports the total amount of Social Security taxes withheld from your paycheck. The Social Security tax is a flat 6.2% of your taxable wage up to the 2023 maximum of $160,200. The maximum amount in Box 4 should not exceed $9,932.40 ($160,200.00 X 6.2% = $9,932.40).

-

BOX 5: MEDICARE WAGES & TIPS

Reports the total amount of wages subject to Medicare tax. There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount in Box 1. Medicare wages include any deferred compensation, 401(k) contributions, or other fringe benefits that are excluded Box 1 federal income tax.

-

BOX 6: MEDICARE TAX WITHHELD

Reports the total amount of Medicare taxes withheld from your paycheck. The Medicare tax rate is 1.45% of your total Medicare taxable wages. Higher income earners may find that the amount in Box 6 is greater than the amount in Box 5. The extra amount is due to the additional Medicare tax of 0.9% for wages paid above 200,000.00.

-

BOX 7: SOCIAL SECURITY TIPS

Reports the total amount of tip income you reported to your employer. If you did not report tips to your employer, you will not have an amount in this box. The amounts in Box 7 and Box 3 may add up to the amount in Box 1 if you do not have any pre-tax benefits or may add up to the amount in Box 5 if you do have pre-tax benefits. The total of Box 7 and Box 3 (together) should not exceed the $160,200 Social Security wage base.

-

BOX 8: ALLOCATED TIPS

This amount is not included in box 1, 3, 5, or 7. For information on how to report tips on your tax return, see your Form 1040 instructions. You must file Form 4137, Social Security and Medicare Tax on Unreported Tip Income, with your income tax return to report at least the allocated tip amount unless you can prove that you received a smaller amount.

-

BOX 10: DEPENDENT CARE BENEFITS

Reports any amounts reimbursed for dependent care expenses through a flexible spending account or the dollar value of dependent care services provided by your employer. Any amount over $5000 is reported as taxable wages in Boxes 1, 3, and 5.

-

BOX 11: NON QUALIFIED PLANS

Reports any amounts distributed to you from your employer’s non-qualified deferred compensation plan or non-governmental Section 457 pension plan. The amount in Box 11 is already included as taxable wages in Box 1.

-

BOX 12: DEFERRED AND OTHER COMPENSATION

There are several types of compensation and benefits that can be reported in Box 12. Box 12 will report a single letter or double letter code followed by a dollar amount.

-

BOX 11: CHECK THE BOX

There are three checkboxes in Box 13. Boxes will be checked off if any of these situations apply to you as an employee.

• STATUTORY EMPLOYEE

Means you report wages from this Form W-2 (and any other W-2 forms marked “statutory employee”) on Form 1040 Schedule C. Your wages are not subject to income tax withholding (there will be a zero or blank amount in Box 2), but are subject to Social Security and Medicare tax withholdings (Boxes 3 through 6 will be filled out). For more information around what constitutes a statutory employee and the rules that apply, see section 1 of Publication 15-A.

• RETIREMENT PLAN

Means that you participated in your employer’s retirement plan during the year. This might be a 401(k) plan, 403(b) plan, SEP-IRA, SIMPLE-IRA, or other type of pension plan.

• THIRD PARTY SICK PAY

Means that you received sick pay under your employer’s third-party insurance policy (instead of receiving sick pay directly from your employer as part of your regular paycheck.) Sick pay is not included in your Box 1 wages, although sick pay is usually subject to Social Security and Medicare taxes. For more information around sick pay and third-party sick pay, see section 6 of Publication 15-A.

-

BOX 14: OTHER TAX INFORMATION

Your employer may report additional tax information in Box 14. If any amounts are reported, they will have a brief description of what the amounts are for. For example, union dues, employer-paid tuition assistance, or after-tax contributions to a retirement plan may be reported here. Some employers report certain state and local taxes in Box 14, such as State Disability Insurance (SDI) premiums. State disability insurance premiums may be deductible as part of the deduction for state and local income taxes on Schedule A. Union dues may be tax-deductible as a miscellaneous itemized deduction. 14

-

BOX 15: STATE AND STATE EMPLOYER’S IDENTIFICATION

Reports your employer’s state and state tax identification number.

-

BOX 16: STATE WAGES

Reports the total amount of wages earned in each state that is subject to state withholding tax.

-

BOX 17: STATE INCOME TAX WITHHELD

Reports the total amount of state income taxes withheld from your paycheck.

-

BOX 18: LOCAL WAGES

Reports the total amount of wages subject to local, city, or other state income taxes.

-

BOX 19: LOCAL INCOME TAX WITHHELD

Reports the total amount of taxes withheld from your paycheck for local, city, or other state income taxes.

-

BOX 20: LOCALITY NAME

Provides a brief description of the local, city, or other state tax being paid