Deduction Calculator

Use our new Deduction Calculator to help configure new 401k plans and edit old ones.

OVERVIEW

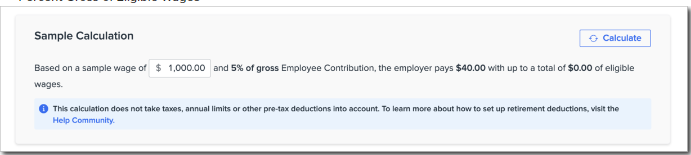

The Deduction Calculator enables you to get a preview of cost details surrounding a 401k based on a sample wage.

Using the Calculator

The calculator can be accessed both on the Company level and Employee level in Namely Payroll. To access the deduction calculator on the Company Level go to Namely Payroll > Company > Deductions > select the current 401k plan that you wish to configure. Scroll down to Employer Cost and there will be an option for a Sample Calculation. Here you can input a sample employee wage and employee contribution amount to find out the subsequent

-

Employer Contribution

-

Percent Gross of Eligible Wages

This calculator can also be accessed at the individual Employee Level by going to Namely Payroll > Employee > Deductions > select the desired employee.

TIP:

The calculation presented should be treated as an estimate and will not take into account taxes, annual limits, or other pre-tax deductions.