Custom Tier Employer Cost Matching for 401k Plans

Namely supports custom tier matching of 401k plans.

Overview

We’ve made managing your 401k employer match settings even easier with a more intuitive user interface and added the ability to apply Custom Tiers to your deduction setup. With Custom Tiers, you have the power to configure your company’s 401k options to create a plan that works best for you and your employees, with more flexibility in how you choose to contribute to your employee’s retirement savings.

Configuring Your Plans

You can configure your 401k plans by going to Namely Payroll > Company > Deductions and either select Edit to update an existing plan or Add to create a new one.

After configuring your employee’s cost by either a flat dollar amount or percentage, you are able to choose the company cost that works best for you and your team.

Employer Cost

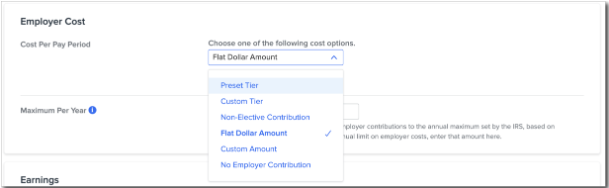

In the updated Employer Cost section you are able to choose one of the following cost options for Cost Per Pay Period.

-

Preset Tier – Already configured tiered 401k options preset by the IRS (Safe Harbor and Automatic Enrollment).

-

Custom Tier – Create your own tiers, with up to three levels of matching on employee contributions.

-

Non-Elective Contribution – A percent of funds per gross wages (pre-tax deduction) or net wages (post-tax deduction) to allocate toward eligible employee plans regardless of employee contribution.

-

Flat Dollar Amount – A static dollar amount to be allocated toward eligible employee plans.

-

Custom Amount – A static dollar or percentage amount to allocate toward eligible employee plans with the option to add a maximum per pay period.

-

No Employer Contribution – No contribution to employee plans.

Custom Tiers

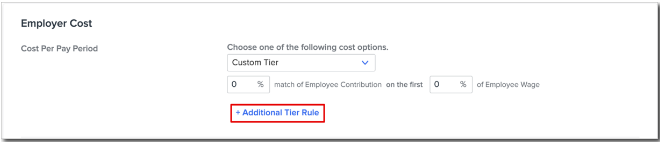

When configuring a custom tier, you will be prompted to provide a percent match of Employee Contribution to be applied on the first tiered percent of the Employee Wage. Add up to three total tiers to cover all iterations of your plan by selecting the Add Additional Tier Rule.

After setting up your tiers, you can also add a flat dollar amount as the Maximum Per Year collection. Adding this amount will ensure that Namely limits combined employee and employer contributions to the annual maximum set by the IRS, based on employee age.

Reporting

In conjunction with this release, we've updated the Employee Deduction Report in Date Range reporting to include:

-

Employee ID

-

Maximum overrides for custom matching amounts

-

New non-elective and flat dollar contribution options captured in the Cost Per Pay field

-

Three new fields to capture custom tier matching configurations

FAQ

I want to edit a current 401k plan I have. Will I lose any information by updating to a Custom Tier?

No. Information like your Deduction ID, Tax Treatment, Start Date, and Employee Cost will all remain the same.

When would I use a Custom Tier?

Custom Tiers are used when you would like to offer your employees 401k contribution match amount based on different levels of contributions. An example would be 100% match on the first 3% of employee contributions, 50% match on the next 2% of employee contributions, and 25% match on the next 1% of employee contributions.

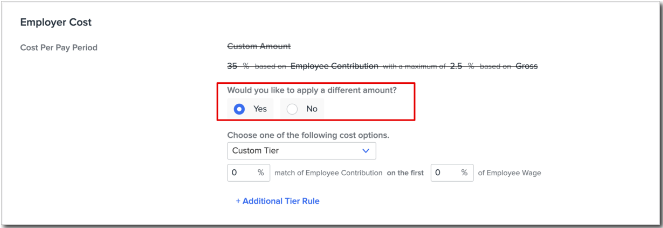

I have a single employee I want to offer custom tiers to. How do I do this?

You can do this by going to Namely Payroll > Employee > selecting the desired employee > Deductions and selecting Edit next to the applicable 401k plan. In the Employer Cost section select Yes for Would you like to apply a different amount?

Then, select the Custom Tier option and configure the desired contribution.