Current Quarter Voids Release

Void pay cycles and paychecks from the current quarter without contacting Service.

OVERVIEW

The ability to process payroll corrections is coming to Namely Payroll with our Current Quarter Voids release.

This update allows payroll administrators to void current quarter employee paychecks and request direct deposit reversals using a Void cycle in the Payroll Center without intervention from the Service team. We are giving you control of your void process!

How to Process a Void and Reversal

If you notice an issue with an employee’s pay, you’ll be able to process a void to correct it by following these steps:

-

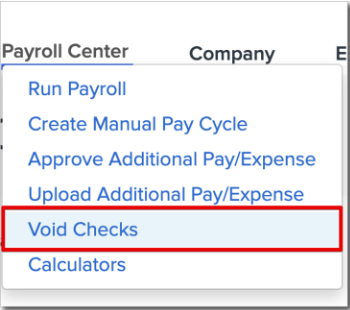

Click Void Checks from the Payroll Center menu in Namely Payroll.

-

Alternatively, scroll to the bottom of the Payroll Center and click Void Checks in the Payroll Voids section.

-

-

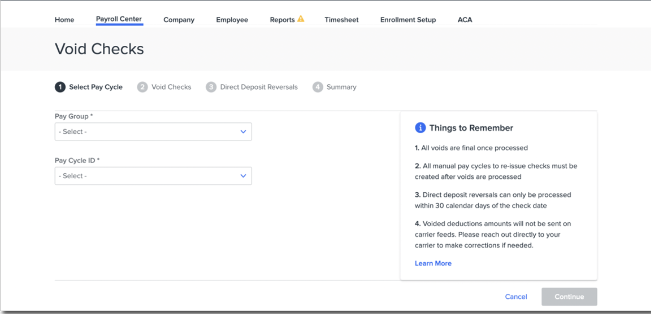

Select the Pay Group and Pay Cycle ID containing the payments you’d like to void and click Continue.

-

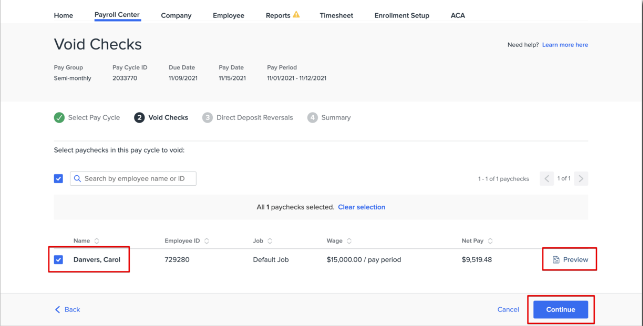

Select the employee checks you’d like to void and click Continue. You can review an employee’s paycheck by clicking Preview to confirm you’re taking action on the correct check.

-

You can check the box to the left of the employee search field to select all employees within the pay cycle.

-

-

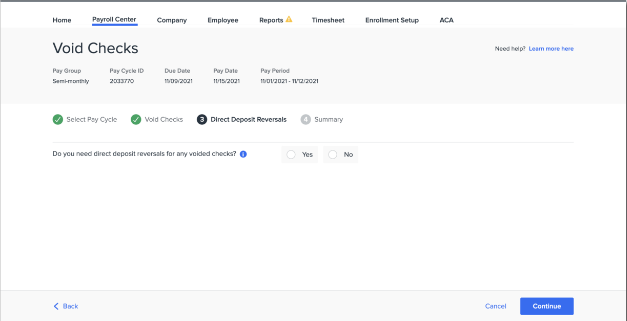

Confirm whether you need a direct deposit reversal and click Continue.

-

If you select Yes, you’ll be prompted to select the checks requiring a reversal.

-

Reversals require a reason. You’ll need to select one of the below reasons to process your reversal:

-

Duplicate Deposit

-

Deposit to Incorrect Account

-

Incorrect Account Deposited.

-

-

Next, click Continue to review a summary of your proposed voids and reversals.

-

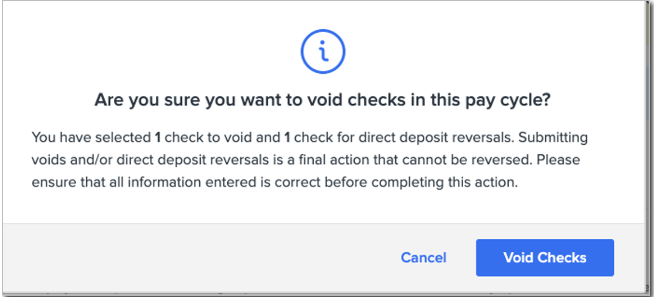

Voids cannot be reversed once processed. The system will ask you to confirm that you want to proceed with the voids and reversals noted. Click Void Checks if you’d like to process your voids.

Important Reminders and Considerations

-

To void prior quarter checks, checks from your final pay cycle in the current quarter, or any current quarter checks when there are no more standard pay cycles in the current quarter submit a case in the Help Community. Select Payroll as the product you need assistance with and Corrections from the list of issues.

-

Don't forget to process a Manual Pay Cycle if you are correcting the Year to Date.

Paper Check Voids

Paper Checks can also be voided by following the same process detailed above. Once the void is processed, you can issue the employee a new paper check via a manual pay cycle.

-

If Namely issued the check, please submit a case in the Help Community using the selections Payroll > Corrections, so our Service team can process a stop payment. Our Service team will process the retraction within one business day, but a successful confirmation can take up to six business days.

-

If your company issued the check, follow up with the affected employee and create a manual pay cycle after the void is processed to issue a new check.

Reversals

Namely’s bank, NPC, processes direct deposit reversals when requested as part of a void. Reversals can take up to six business days to process, and they are not always successful. If your reversal fails, we recommend following up with the employee to retrieve funds.

If you need to process a reversal without a void you will need to submit a ticket to our Service team.

TIP:

Processing a void removes all records of the voided check from Namely Payroll. If corrections are required to your employee’s pay record, you will need to follow the Void process with a Reissue Cycle to populate the corrected information back into Namely Payroll. Use the directions in our article Understanding the Void and Reissue Process to complete a void and reissue.

TIP:

Partial reversals for employees with funds allocated to multiple bank accounts cannot be processed.

Reversal Fees

A fee of $100 is automatically billed on your next standard payroll for each reversal request.

Viewing and Reporting On Voids and Reversals

Void and Reversal Status

You can track the status of your voids and reversal requests directly in the Payroll Center. Scroll to the Payroll Voids section, and you’ll see your active Voids. You’ll note a column for Void Status and Reversal status that will indicate the status of your void and reversal.

The void cycle will process with your next standard pay cycle and will reduce the standard pay cycle’s tax liability. This is how you will receive a refund for taxes from the voided check. If the reversal is successful, the net pay will be credited back to your account. The reversal will include the previously collected net pay amount.

Reports

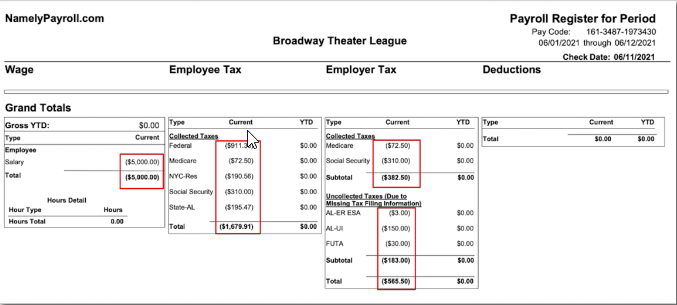

Namely stores data on voids and reversals in our Reporting engine. You can view reports on your void cycle by going to Reports > Pay Cycle. Select your Void cycle from the list of pay cycles. We recommend clicking Payroll Summary to view the details from your void.

TIP:

The Payroll Summary report will contain the voided check data, but no reversal data. Reversal data will be visible on reports for your next pay cycle.

You can also view voided check data on our Payroll Register Report. In this report, previously collected wages and tax liability amounts will display in parenthesis.