COVID-19 Deferred Tax Amounts on PDF Payroll Register – Released 4/9/2020

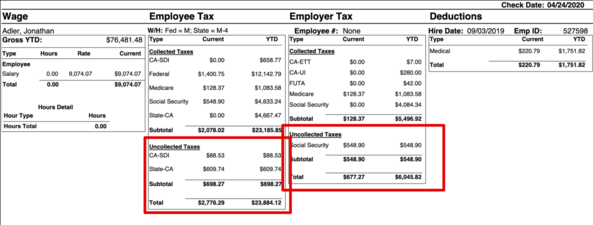

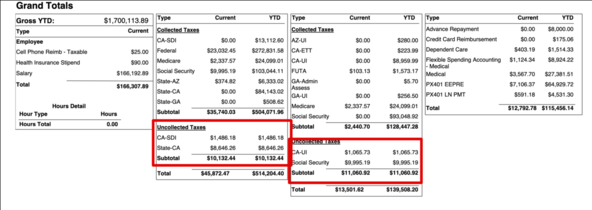

We've added fields for uncollected taxes being deferred under COVID-19 legislation on the PDF version of the Payroll Register Report.

For companies that are deferring employer Social Security taxes or state taxes as a result of COVID-19 relief legislation, we've added fields displaying the uncollected tax amounts on the PDF version of the Payroll Register report.

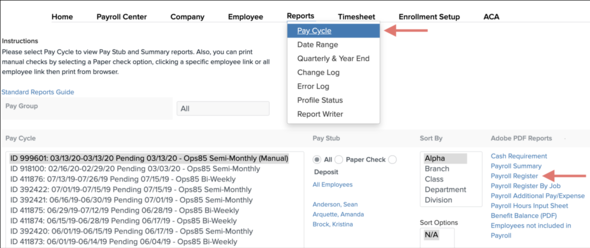

You can access the PDF Payroll Register report by going to Reports > Pay Cycle and clicking Payroll Register under Adobe PDF Reports.

Please note: Uncollected taxes currently only display in the PDF version of the Payroll Register report. They will not display in Excel or CSV files.