2024 Wage Base Rises for Social Security Payroll Taxes

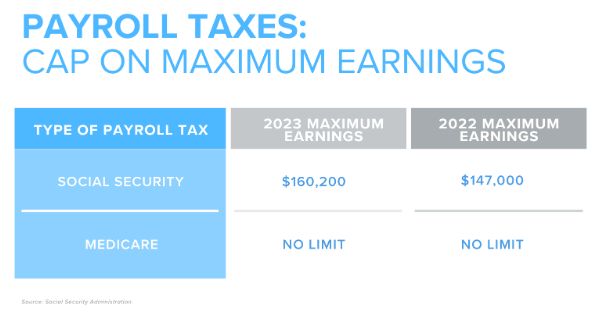

2024 Wages subject to Social Security FICA taxes will go to $168,600 from $160,200.

OVERVIEW

Starting January 1st, 2024, the Social Security Administration (SSA) announced October 13th, 2022 that the maximum earnings subject to the Social Security payroll tax will increase by $8,400 to $168,600—up from the $160,200 maximum for 2023. The SSA also posted a fact sheet summarizing the 2023 changes.

The taxable wage base cap is subject to an automatic cost-of-living adjustment (COLA) each year based on the increase of the national average wage index which is calculated annually by the SSA.

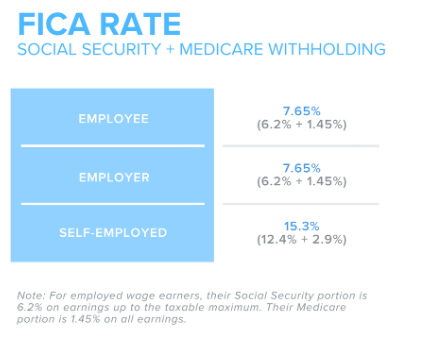

FICA RATE (SOCIAL SECURITY + MEDICARE WITHHOLDING)

The maximum 2023 Social Security component of the Federal Insurance Contributions Act tax payable by each employee is $9,932.40 (which is 6.2% of the taxable wage base) up from $9,114.00 for 2022. Employers will match the employee amount with an equal contribution.

The Medicare (Hospital Insurance) tax rate remains at 1.45% and is applicable to all wages paid during the year. Per the agency, an additional Medicare tax of 0.9% applies to individuals with an annual earned income of more than $200,000, and $250,000 for married couples filing jointly. While employers are required to pay a matching 1.45% portion of the standard Medicare tax, employers are not required to pay a matching 0.9% portion of the additional Medicare tax.

Example:

For 2024, an employee who earns exactly $168,600 is subject to a total FICA tax (Social Security tax plus Medicare tax) of $12,897.90 ($10,453.20 + $2,444.70).

Namely will be adjusting our system in accordance with the newly released wage base cap effective for pay dates 1/1/24 and after.