PEO Transition Guide

Use this article as a guide to ensure you successfully graduate from your PEO provider.

OVERVIEW

This PEO Transition Guide will help you effectively graduate from your former provider to one of Namely's offerings - SaaS, Managed Payroll and/or Managed Benefits. It compiles people operations processes and tasks you'll want to establish owners for on your team, as well as a number of other items to consider as you transition to our service.

TIP:

If you purchased our PEO Transition service, your Namely Implementation team will cover the below items in addition to the Implementation Discovery Call Process to assist you in defining the process and ownership internally!

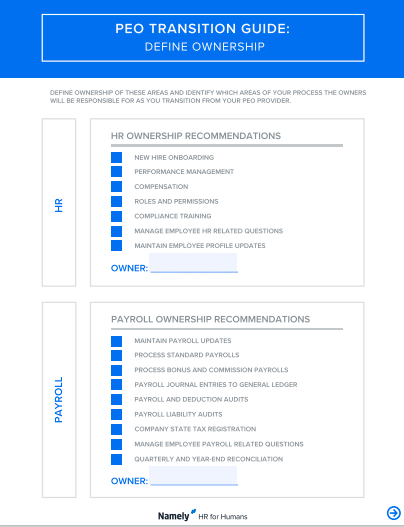

DEFINE OWNERSHIP

Defining ownership for HR, Payroll and Benefits workstreams and the critical tasks that fall into each bucket will help you effectively manage your team and company in Namely. Use this checklist to help you assign work to your team.

Once you've defined ownership for critical tasks and workstreams, you can start preparing for your transition! The remainder of this article will guide you through a series of items to consider and data points to confirm to make your transition as seamless as possible.

PROVIDE PROOF OF EIN

When transitioning from a PEO, confirm that you have your Company’s FEIN registered with the IRS. Namely will request a letter from the IRS as proof of your EIN and your EIN’s most current address.

TIP:

Confirm and request an IRS letter to use as EIN Proof from the IRS Website.

DATA PREP REQUIREMENTS

As you prepare to transition your company and employee data to Namely, you'll want to confirm with your current PEO vendor that you have access to these critical items. Your Data Services consultant will request the below items at the very beginning of the implementation process.

Confirm Access To

-

Employee Demographic Data

-

Taxable YTD wages in any states that were filed under the company’s ID

-

These states are eligible for wage continuation when you transition to Namely

-

-

A listing of your company’s Earnings and Deductions

-

401K deductions, Loan Balances, and HSA/FSA Balances

-

These balances will need to be brought forward to Namely

-

-

Garnishment Information

State Filings to Confirm

Confirm any states that have been filed under the company’s agency IDs. The following states are typically filed under your company's ID by your PEO:

|

|

Data Prep - Historical Information and Documents to Consider

These items are not required but are recommended items you may want to bring over to Namely during your transition.

|

Employee W-4 and I-9 Documents |

Job and Salary History |

Performance Reviews and Performance Ratings |

|

Employee Certifications |

Company Assets |

Additional items you may want to consider housing in Namely |

HR ITEMS TO CONSIDER

When transitioning from your PEO, your HR owner should consider the following areas of responsibility.

Wrap and Pop Documents

As your company’s plan sponsor, you will need to ensure that you have Wrap and Pop documents on file. Refer to the following links from our Comply Database for more information on these documents:

|

Why Employers Need Updated ERISA and IRS Benefit Plan Documents |

HOW CAN NAMELY HELP?

If you need assistance creating these documents, Namely can help through our Mineral partnership! Ask your Namely consultant for more information on how we can assist.

Workers Compensation

Do you have an administrator for workers comp? If not, your team will need to determine who will be the point person for workers comp and how you'll manage it internally.

HOW CAN NAMELY HELP?

Namely can help you with workers comp through our partnership with The Hartford offered through the services from Intermarket Insurance! Refer to Workers Compensation to learn more about how we can assist you.

Employee Handbooks

Does your company have an existing employee handbook? If not, your team should determine how your handbook should be prepared, distributed, and maintained.

HOW CAN NAMELY HELP?

If you need assistance creating Handbooks, we can help with our Namely Comply Database and Compliance Plus powered by Mineral.

Compliance Learning Management System

Make sure you have a Learning Management System (LMS) in place to help ensure that your organization is set up for proactive and reactive risk management.

HOW CAN NAMELY HELP?

If you don't have a Compliance LMS set up, our Namely Comply Database and Compliance Plus offers a broad array of training solutions!

PAYROLL ITEMS TO CONSIDER

When transitioning from your PEO, your Payroll owner should consider the following areas of responsibility.

Federal Wages

Are you transitioning from a CPEO or PEO relationship?

The IRS recognizes federal wages that were processed under a Certified PEO vendor. Your employees' federal wages are eligible for wage continuation and will be carried forward when you transition to Namely.

Next Steps

In order for Namely to move forward with Federal Wage Continuation, we will need a copy of your Form 8973 as proof of your CPEO relationship.

-

Form 8973 is required to load wage continuation for federal wages. This requirement ensures that you are moving from a CPEO relationship and will not be liable for any penalties or fees from the IRS by using Federal Wage Continuation.

-

If you do not have an 8973 and would like to move forward with Federal Wage Continuation, sign a Certified Professional Organization (CPEO) Attestation Form.

State Registrations

Your organization will need to register for the applicable states that your PEO previously filed for under the PEO’s ID.

HOW CAN NAMELY HELP?

Namely offers Tax Registration Services (free for Managed Payroll Clients) to assist with the administrative work in registering and applying for tax jurisdictions. Request a Tax Registration Services Project to get started today!

Things to Consider:

-

We recommend having a legal or tax advisor on staff to assist in any tax registration questions that are specific to your business.

-

If you prefer to register and apply for jurisdictions on your own, refer to our Namely Toolkit: Tax Services.

Mid-Year Transitions

For mid-year transitions, your employees will receive two sets of Form W-2.

-

One set of W-2s processed under the PEO's service

-

One set of W-2s process under Namely's service

Work Opportunity Tax Credit Programs

If you currently participate in any Work Opportunity Tax Credit Programs (WOTC), coordinate with your payroll and finance team to finalize how these programs will be managed internally.

BENEFIT ITEMS TO CONSIDER

When transitioning from your PEO, your Benefits owner should consider the following areas of responsibility.

Carrier Feeds

-

Prior to our carrier feed build process, confirm with your carriers that they will accept feeds from Namely. Some carriers may not accept feeds based on the group size.

-

Because we rely on communication and testing from your carrier, it may take around 10-12 weeks for your carrier feed build. Refer to Carrier Feeds: Getting Started for more information on starting the build process.

HOW CAN NAMELY HELP?

Namely offers a Carrier Feed service where we will build your company’s carrier feeds according to your Carrier’s specs. To begin, your Namely Ben Admin Consultant will direct you to submit a Carrier Feed Project request.

-

If you are not utilizing our Managed Benefits service, determine the responsibility and ownership of manually feeding your carrier feed information to carriers until the feeds are built. Some Brokers may offer assistance with this.

HOW CAN NAMELY HELP?

If you are a Managed Benefits client, Namely will assist with feeding your carrier feed information to carriers until your carrier feeds are live.

Insurance Billing

Determine a process on how to manage your insurance billing internally! Your team should decide who will take responsibility and ensure a process is in place to pay carriers.

Employee's Benefit Related Questions

If your organization is not utilizing the Namely Managed Benefits Pro service, you must determine who will own responsibility for these questions post-transition.

HOW CAN NAMELY HELP?

If your organization utilizes Namely’s Managed Benefits Pro service, we can assist in answering employee questions through the Touchcare platform. Consult with your Namely brokerage consultant for more information regarding the Touchcare platform.

Evidence of Insurability

If your organization is not utilizing our Managed Benefits platform, you should determine who will manage processing Evidence of Insurability forms. Refer to Evidence of Insurability Processing for more information.

HOW CAN NAMELY HELP?

Namely will coordinate with insurance carriers if you utilize our Managed Benefits platform.

ACA Reporting

Does your company have at least 50 employees? If not, do you plan to surpass 50 employees this calendar year?

HOW CAN NAMELY HELP?

Namely offers an ACA reporting service. In order to utilize ACA reporting with Namely, you will need to confirm if the PEO will file on the company’s behalf for the time spent with the PEO.

-

Example 1: If your company joins Namely on 1/1/2022. Will the PEO file for 2021 when reporting is due in March 2022?

-

Example 2: If your company joins Namely on 7/1/2021. Will the PEO file for January 2021 to June 2021 when ACA reporting is due in March of 2022?

If you are utilizing Namely to complete your ACA Reporting (refer to your contract to confirm if you have ACA reporting as part of your Namely subscription), your team will need to provide all current and historic benefit enrollment data to Namely.

If you are not planning on having Namely complete ACA reporting for your company, compile current and historic benefit enrollment data and complete all ACA reports that your company is responsible for internally.

Refer to the following toolkit and blog articles for more information on ACA reporting:

|

|

Short Term and Long Term Disability

If your previous vendor handled Short Term Disability (STD) and Long Term Disability (LTD) claims on your behalf, ensure that your team determines how this will be managed internally moving forward.

Familiarize yourself with the below resources on best practices when managing Short Term Disability and Long Term Disability:

|

Namely Blog: What is Third Party Sick Pay? |

|