Implementing PEO and CPEO Clients Mid-Year Or Mid-Quarter

Payroll Consultants should use this guide to implement new clients coming from a PEO or CPEO provider during mid-year or mid-quarter.

OVERVIEW

A Certified Professional Employer Organization (CPEO) client and Professional Employer Organization (PEO) client require a different approach when being onboarded into the Namely Payroll system.

CPEO vs PEO Clients

First, let's understand the difference between a CPEO and PEO client.

|

CPEO |

PEO |

|

A client that is eligible for FUTA and FICA wage continuation. |

A client that is not eligible for FUTA and FICA wage continuation, therefore, wage base limits reset with the transition to Namely. |

|

The client is required to provide Form 8973 as proof that they are transitioning from a CPEO provider.

If the client is unsure of their CPEO status, they can reference the IRS list of CPEO's . |

|

Both CPEO's and PEO's are eligible for state wage continuation in certain jurisdictions. The client is required to provide a clear list confirming which taxes were filed under the company’s own tax ID. It's important they list taxes under their company's unique tax ID and not their PEO provider's.

TIP:

If the client’s PEO provider filed taxes under the company’s ID number, instead of the PEO/CPEO’s ID number, then that jurisdiction is eligible for wage continuation and we will import prior taxable wages. The client is still responsible for confirming with agencies if they are eligible.

-

This is true for all states except NY PFL and HI SDI. Both must be imported (if applicable) regardless of being filed under the client's own tax IDs or not.

TIP:

For any jurisdictions that were filed under the PEO’s ID number, the client will need to register for their own ID with the respective agency. Please refer to the Tax Registration Project and Tax Tool Kit.

How to Import Prior Taxable Wages

Follow the steps below for importing prior taxable wages in Back Office Legacy (BOL).

-

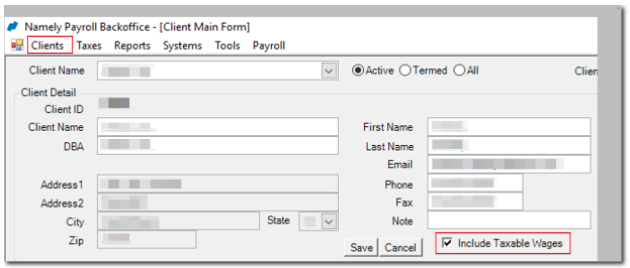

Select Include Taxable Wage in BOL under Clients and click Save.

-

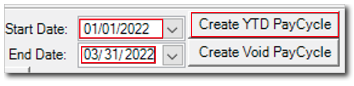

Create a YTD Pay Cycle in BO (1 per pay group) under Taxes > YTD and Void. Pay cycle dates should reflect the full timeframe in which the client processed under the PEO within the current year.

TIP:This is typically 1/1/20XX - the final pay date under the PEO. The period end date and pay date should mirror each other.

-

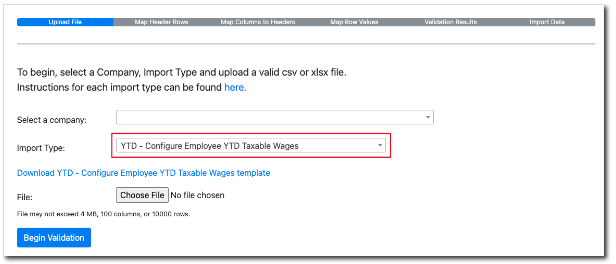

Ensure your import file is in the correct format. See downloadable template within Turnstile tool.

-

Import file

-

Select YTD - Configure Employee YTD Taxable Wages as the Import Type.

-

-

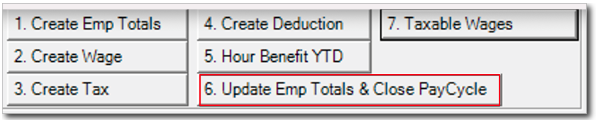

Close the YTD Pay Cycle

-

Run the CPEO Taxable Wages Report in Namely Payroll under Reports > Date Range. Provide to the client for reference when completing the Historical Data Sign Off.

Deduction Annual Maximums

When transitioning from a PEO provider, it is important to reduce the Annual Maximum by the YTD amount already contributed. This prevents employees from over-contributing to deductions with annual limits such as 401K/Roth, HSA, FSA, and Commuter Benefits.

Determining the Remaining Annual Allowance

Annual Limit - YTD amount = Employee Annual Maximum

|

Deduction Type |

Annual Limit (2022) |

|

401K/Roth |

$20,500 ($27,000 if 50+ y/o) |

|

HSA (EE Only Plan) |

$3,650 ($4,650 if 55+ y/o) |

|

HSA (Family Plan) |

$7,300 ($8,300 if 55+ y/o) |

|

FSA |

$2,850 |

|

Dependent Care FSA |

$5,000 (individuals or married couples filing jointly) or $2,500 (married filing separately) |

|

Commuter (Transit/Parking) Benefits |

$280/mo ($3,360 annually) |

How to Add Any Remaining Deduction Annual Maximums

Deduction annual maximums can be imported or manually added within employee deductions in Payroll > EE Annual Maximum by following the steps below.

-

Create an import template with the following columns

-

Employee Names

-

EE ID or Email

-

Deduction Name

-

Start Date

-

EE Annual Maximum

-

-

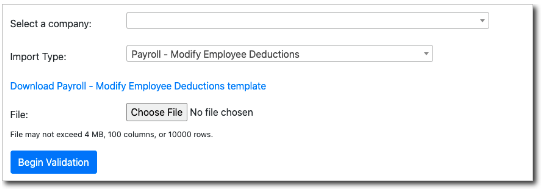

Fill out the Modify Employee Deductions template and import using Import Tool Beta.

After you have finished importing YTD taxables and deduction limits send the client the following

-

CPEO Taxable Wage report steps for the client to review and confirm.

-

YTD Historical sign-off.

-

Report Writer instructions to pull a Deduction report (which includes the EE Annual Maximum field).

-

Ensure you’re Informing the client that the Deduction EE Annual Max amounts need to be cleared out before their first payroll of the new year.

-

Note: If the client has MP, they will clear these amounts for the client.

-

-