Company Tax Profile: Submitting a New Company Set Up Case

OVERVIEW

This article provides instructions for the implementation team to submit a case to our Tax team to set up a client's company in MasterTax. Once the client's company tax setup is complete in Back Office Legacy, you'll want to submit a New Company Setup case to the Tax team. This should be done no later than two weeks prior to the client's first check date with Namely.

If you encounter an instance where a rush build is needed - i.e. the case is being created later than the two week deadline, tag Jen Mizer, Mike Ennis, and Elke Jones in your case.

NEW COMPANY SETUP CASE

Follow these steps to create your case.

-

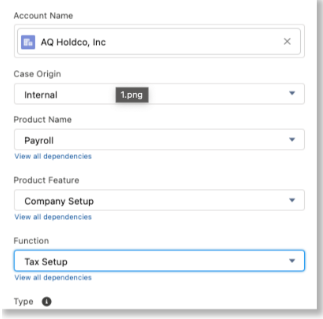

Create a case in Salesforce using the following taxonomy:

-

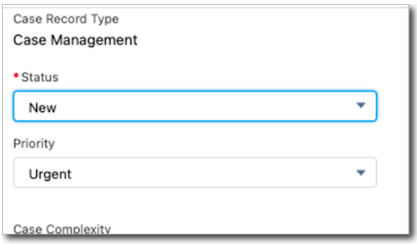

Case Type: Case Management

-

Case Origin: Internal

-

Product Name: Payroll

-

Product Feature: Company Setup

-

Function: Tax Set Up

-

TIP:

If this case is Urgent and/or needs to be completed within 2 weeks of the client's processing date, select Urgent in the Priority field.

-

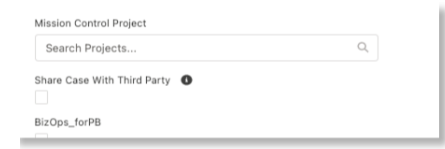

Enter the Mission Control Project this case is associated with.

-

Enter Contact Name information.

-

This information links the case to the Client’s Account.

-

-

Follow the naming convention to enter the Subject.

-

Subject: CID XXXX - [Company Legal Name as Shown on IRS Letter] - New Company Setup

-

The company name must match exactly how it is shown on their IRS document.

-

-

Examples:

-

-

Subject: “CID 7826 - RAZR Marketing Inc - New Company Setup”.

-

“RAZR Marketing, Inc” with the comma, is incorrect.

-

Type the following in the Description field.

-

Description: Taxes have been created in BOL. Please set up in MT.

-

First Check Date: xx/xx/xxxx

MT Start Date: xx/xx/xxxx

IRS Letter: [Google Drive Link to IRS Letter]

-

-

Things to Consider:

-

Namely will only accept documentation from the IRS that displays the Company’s Legal Name, Address, and unmasked FEIN. If either the Name or Address has been changed, the client will need to obtain new documentation from the IRS by calling 1-800-829-4933. We will be using the Name and Address reflected on the document they are able to provide at the time until a new document is provided.

-

If a letter from the IRS cannot be obtained, the most recently filed 941 will suffice.

-

If the client’s start date changes, you must update the MasterTax Start Date in Namely as well as inform the Tax Team via this case of the new date by tagging them in the chatter and re-assigning the case to the Tax Ops Queue.

-

-

-

Assign the Case. Once the case has been created, assign the case to the Tax Ops Queue for the Tax team to create the client's MasterTax profile. Upon completion, the Tax team will attach the client’s Power of Attorney forms (POAs) and let you know of any crucial missing information.

-

Go to DSD.namely.land > Payroll Audit. Find your client and download the report to attach to the case.

-

Use the following template to communicate with the client within the case using the All with Access chatter function and upload the Company Tax Verification Report and POAs to the client’s Support Files.

Hi [CLIENT],

I hope your week is going well. Our Tax Team was able to do an audit on our account. Attached you will find your report reflecting the IDs and Rates currently set up in Namely. Please review and if any updates need to be made you can make them by going to Namely Payroll > Company > Taxes. If all looks good, please reply to this email confirming so by [DATE].

Missing Tax Information:

[Provide any missing tax information outlined by the Tax Team]

Additionally, you will also find your prefilled POAs. Instructions for completing the forms can be found here Completing the Power of Attorney Package. Please complete/sign the forms and email them to NamelyPOA@namely.com with the company ID in the subject line of the email. Also please send one email with each state form as a separate PDF. If there are any questions, please direct them via email and we will respond.

NOTE - some of these forms require a Notary and all forms require a live signature.

Additionally, you will also find your prefilled POAs All Power of Attorney forms must be signed by an Officer, Owner or an Authorized person of the business with a live signature as agencies are not accepting digital signatures at this time. Power of Attorney’s will not be created if the account number is in Applied For status. A pre-filled Power of Attorney will be created once the account number is obtained and updated in Namely Payroll.

*** IMPORTANT REMINDER: Namely cannot make payroll tax deposits or file payroll tax returns without the federal, state, and local agency assigned account numbers, payment numbers, and/or agency authorizations as directed per the individual state jurisdiction. If Namely is not provided the necessary information in a timely manner your company will be responsible for penalties and interest due to late payment(s) and late filing(s).

TIP:

If any other action is required from the Tax Ops team, chatter them in the case and reassign the case to the Tax Ops Queue.