How do I update a contractor to a full-time employee?

There are two methods for moving a contractor to full-time status, depending on the employee’s history. Please see the appropriate instructions, depending on the employee's situation:

Option 1 is used for situations where:

-

Contractor to Full Time, with no gap in between, where their start date is the same start date as when they were hired as a contractor.

Option 2 is used for situations where:

-

Contractor to Full Time, with no gap in between, where their start date equals their start date as a full-time employee.

-

Contractor to Full Time, with day(s) between their time as a contractor and a full-time employee.

Option 1

For a Contractor to Full-Time, with no gap in between, where their start date is the same start date as when they were hired as a contractor.

Scenario: (1) A contractor to full-time employee completed their last day as a contractor and started as a full-time employee the next day with no gap between the two. (2) The employer would like their start date to be reflective of their start date as a contractor to show their entire history with the company.

Change Process

-

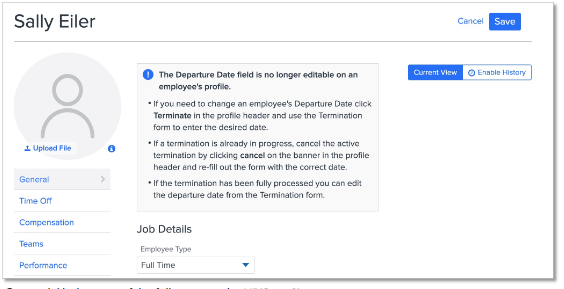

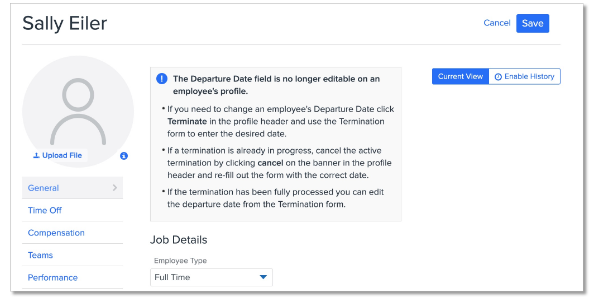

Navigate to the employee's HRIS profile > select the three dots in the right-hand corner > Edit > on the General tab update their Employee Type from Contractor to Full Time.

-

(Optional) Update any of the following on the HRIS profile, as necessary:

-

Access Role- if you would like them to have additional access to the site as a full-time employee

-

Pay Group- if you are paying them through Namely Payroll for the first time

-

Compensation- if their salary is changing after becoming a full-time employee

-

Reports To field- if their manager is changing after becoming a full-time employee

-

Time Off- if they should be added to any time off plans as a full-time employee. Please note, any time off plans they are added to will accrue according to their contractor start date, not their start date as a full-time employee.

-

-

(Optional) Send them any eSignature documents to sign via Manage eSignature. For more information concerning sending documents, please see Managing eSignature Documents.

-

(Optional) Update their tax information in Namely Payroll, as necessary.

Option 2

Contractor to Full Time, with no gap in between, where their start date equals their start date as a full-time employee.

Scenario: (1) A contractor to full-time employee completed their last day as a contractor and started as a full-time employee the very next day with no gap between the two. (2) The employer would like their start date to be reflective of their start date as full-time employee. The employer would like to keep the employee’s historical data from their time as a contractor listed on his profile for documentation purposes, but the primary date associated with the employee’s profile is their start date as a full-time employee.

-or-

Contractor to Full Time, with day(s) between their time as a contractor and a full-time employee.

Scenario: A contractor has a gap (1+ business days) in employment between their last day of employment as a contractor and their first day of employment as a full-time employee.

Change Process

Treat the employee as a rehire in Namely:

-

Navigate to the employee's HRIS profile > select the three dots in the right-hand corner > Edit > on the General tab update their Employee Type from Contractor to Full Time.

-

Follow the instructions in Rehires in Namely to rehire the employee in the system.

-

(Optional) Update any of the following on their HRIS profile, as necessary:

-

Access Role- if you would like them to have additional access to the site as a full-time employee

-

Pay Group- if you are paying them through Namely Payroll for the first time

-

Compensation- if their salary is changing as a full time employee

-

Reports To field- if their manager is changing as a full time employee

-

Time Off- if they should be added to any time off plans as a full time employee. Please note, any time off plans they are added to will accrue according to their contractor start date, not their start date as a full time employee.

-

-

(Optional) Send them any eSignature documents to sign via Manage eSignature. For more information concerning sending documents, please see Managing eSignature Documents.

-

(Optional) Update their tax information in Namely Payroll, as necessary.