How do I set up a deduction for loan repayment?

When setting up a deduction for a loan, you will go through the typical process for setting up any deduction- i.e., creating the deduction code on the company-level, then adding the deduction and amount to the particular employee's profile. For more information on this process, please see: Company and Employee Level Deduction Setup

With a deduction for a loan that has a fixed total due for the repayment, you can also add this total to the employee-level deduction so that the deduction will automatically turn off when the amount is fully paid.

To enter this amount:

-

Go to the employee profile > Deductions.

-

Click Add to enter the new deduction.

-

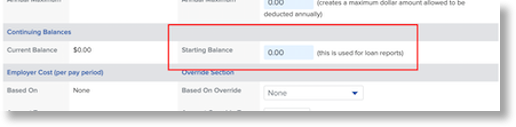

Under Continuing Balances, you can enter the outstanding loan amount in the field Starting Balance.

Note: the Starting Balance field is only effective on deduction types Garnishment and Loan Repayment.