How do I read the tax variance reports?

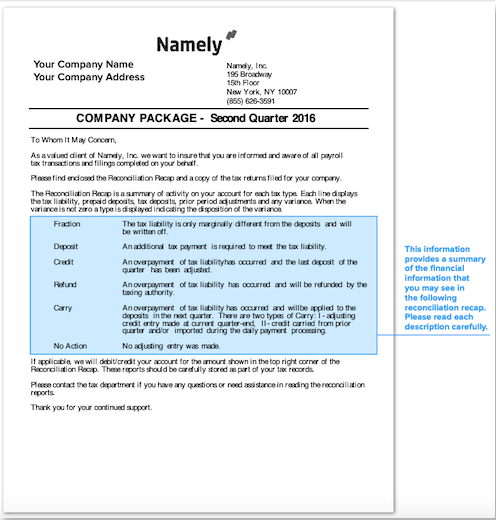

On the cover page, you’ll find descriptions for each type of deposit that you could potentially see on the report.

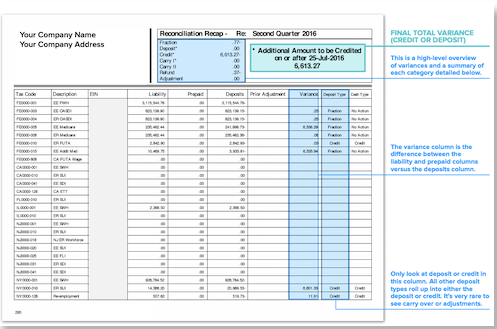

On the reconciliation recap page (page 2 of the report), you’ll find:

-

The total tax variance credit or debit (top left-hand corner).

-

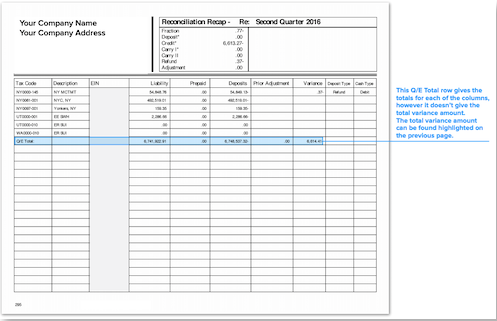

Carry: Amounts classified as ‘carry’ are being carried over to next quarter as a credit. There is no immediate impact at this time, so carry amounts do not roll up to the deposit or credit amount.

-

Refund: Amounts that you can anticipate receiving back from the agency.

-

Adjustments: These are rare, but they are amounts (credits or debits) from the prior quarter that affect the current quarter.