How can I print my employees’ W-2s and 1099s directly from Namely?

Namely Payroll provides reporting that can help you and your organization with your tax form printing needs.

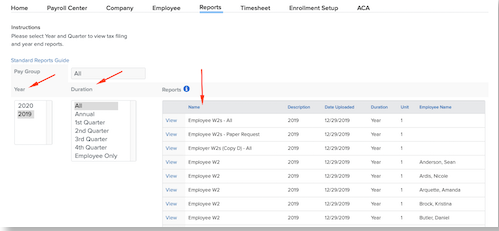

Once tax forms are made available to your organization in January, you can find these reports in Namely Payroll by going to Reports > Quarterly & Year-End, then selecting the appropriate Year and Duration (i.e., annual or quarterly forms).

Once the list of forms populates, you have the option of viewing/printing:

-

An individual employee's form

-

All of your employees' forms (Employee W2s - All)

-

All of the forms for your employees who have requested or defaulted into paper delivery (Employee W2s - Paper Request)

For each employee, you will see three pages you will need to send:

-

A cover page with the employee's mailing address. Please see Note below on details about how to mail the forms.

-

A second page with copies of the W-2 itself (with multiple copies to facilitate easy submission to multiple agencies, if necessary).

-

A final page with instructions from the IRS.

Note: Tax documents are printed horizontally to conserve paper and are 100% compliant with IRS guidelines. The documents will be suitable for mailing in a size #9 double-windowed envelope.*

* Envelope requires a top window height of ⅞” x 3½” and is positioned ⅜” from the left, 2 ⅜” from the bottom. The bottom window height is ⅞” x 3 ½”, and is positioned ⅞” from the left and ¾” from the bottom. Click here for a sample envelope template.