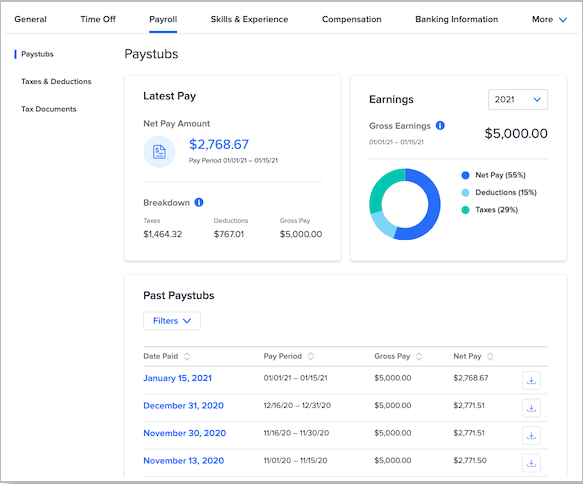

Payroll Tab in Employee Profile

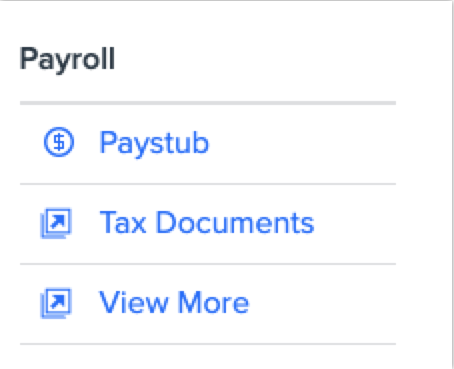

We’ve released a new Payroll tab on employee profiles, providing seamless access to paystubs and a more comprehensive breakdown of employee pay.

OVERVIEW

We’re making it easier for your employees to access their paystubs, and for the first time, providing detailed visualizations of paycheck breakdowns right in Namely.

Employees can now click the new Payroll tab on their profile to access their paystubs—there’s no need for them to go to Namely Payroll (though paystub information will still be accessible there for terminated employees and Payroll administrators).

|

IMPORTANT: EMPLOYEE W-2, 1099 ACCESS and APPROVING TIMESHEETS

|

ACCESSIBILITY

-

Employees will be able to see their own Payroll tab but not other employees’ Payroll tab.

-

Payroll administrators will be able to see employee paystubs in Namely Payroll. Payroll administrators can also see the Payroll tab of any user for whom they have the Ability: Assume users permission when viewing as that user.

-

Administrators in Namely HRIS will be able to see the Payroll tab of any user for whom they have the Ability: Assume users permission when viewing as that user.

-

Please note: You can adjust a role’s Ability: Assume users permission to give anyone assigned to that role the ability to view another user’s Payroll tab when viewing as that user.

-

For example, you could give a manager the ability to view their team members’ Payroll tabs by adjusting the Ability: Assume users permission to Direct Reports. For information on updating user role permissions, visit our Help Community.

-

A BETTER WAY TO VIEW YOUR PAY

Users of Namely’s mobile app for iOS and Android will be familiar with the layout of the new Payroll tab.

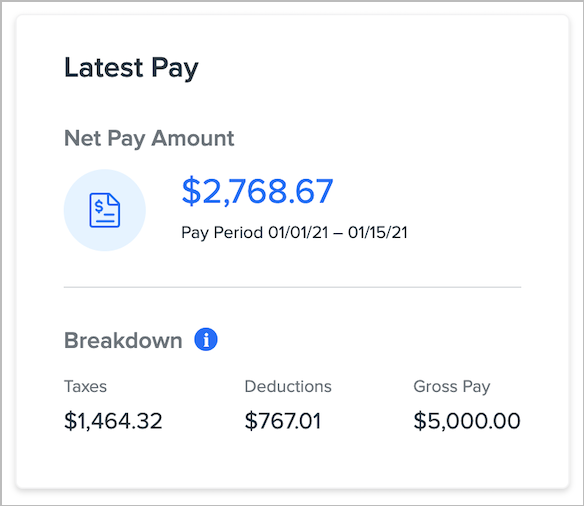

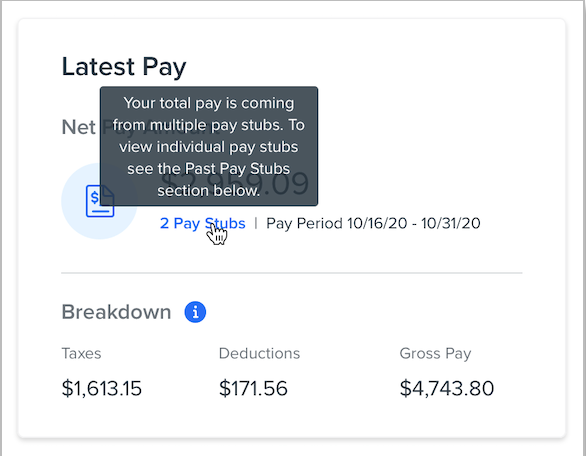

Latest Pay

The Latest Pay widget provides an overview of net pay, taxes, deductions, and gross pay from the employee’s most recent paystub—along with the pay period that stub covers.

-

Employees can click the Net Pay Amount to view a PDF of their most recent paystub.

-

Hovering over the Info icon in the Breakdown section provides definitions for taxes, deductions, and gross pay, so employees always have a clear understanding of how their compensation is distributed.

-

If an employee receives multiple paystubs on the same pay date, that will be noted, along with instructions on how to access these stubs in the Past Paystubs section.

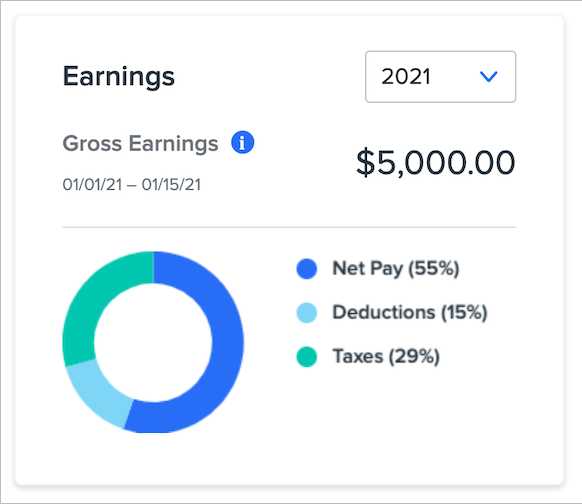

Earnings

The Earnings widget provides an overview of gross earnings, net pay, deductions, and taxes the employee has earned or paid to date in a specific year.

-

When selecting the current year, year-to-date totals will display. Selecting past years will display annual totals.

-

Please note: These totals should not be used for tax filing purposes. Employees should only use official W-2s when filing their taxes.

-

-

Net Pay, Deductions, and Taxes will be shown as a percentage of Gross Earnings. To view dollar amounts, hover over a specific category in the chart.

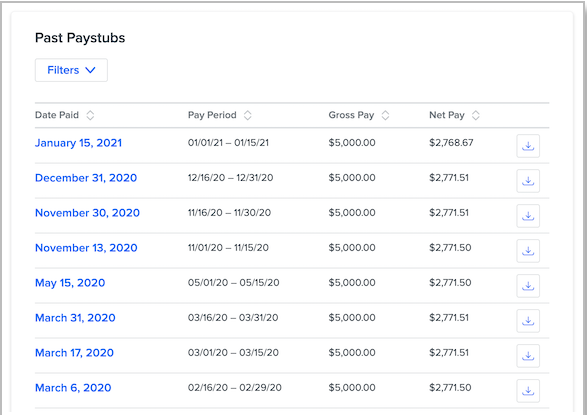

Past Paystubs

-

Paystubs are listed by Date Paid, along with the Pay Period the check covers, and the Gross and Net Pay totals from that specific stub. Employees can hover over column headers for more information on Gross Pay and Net Pay.

-

Click the Date Paid to view a PDF of that paystub in your browser. Click the Download icon on the right to download it to your computer.

-

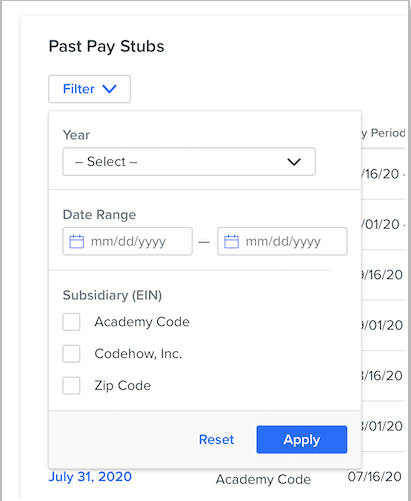

Employees can filter their listed paystubs by Year or Date Range.

-

If an employee is paid via multiple subsidiaries (EINs) they can select the specific subsidiary they want to view paystubs for.

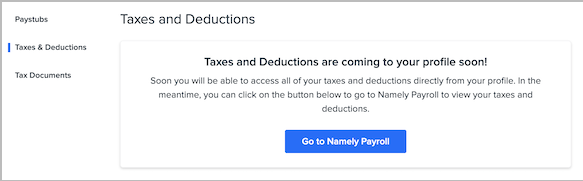

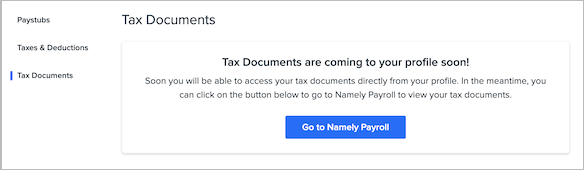

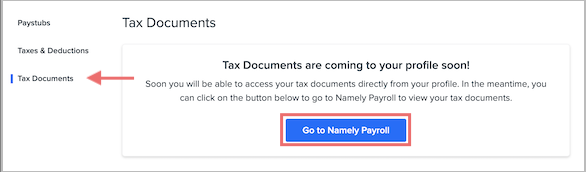

COMING SOON... TAXES AND DEDUCTIONS, YEAR-END DOCUMENTS

In addition to paystubs, we’ll soon be surfacing lists of all taxes and deductions an employee is subject to, as well as year-end tax documents like W-2s and 1099s, directly on the Payroll tab.

Until then, links will redirect to Namely Payroll to provide access to these resources.