Payroll Processing Audits: Profile Status Review

This article provides instructions on how to review employee profile information during the payroll processing audits.

OVERVIEW

The Benefits Election review is part of a series of audits and tasks we recommend completing to process payroll accurately and efficiently. Refer to Namely Recommended: Preparing to Process Your Payroll for more details.

Follow the below steps to make sure that all of the employee information within the HRIS employee profile is accurate to ensure a successful HRIS and payroll sync. Refer to Profile Status Page Checklist to learn more about which profile fields are required to run payroll.

REVIEWING PROFILE STATUSES

View the Profile Status

-

In the HRIS home page, click Profile Status under Admin Tools.

-

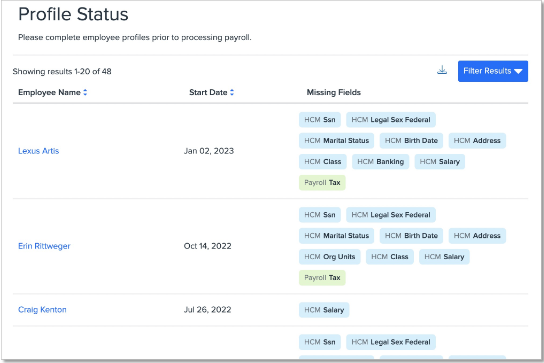

Identify the employee and the incomplete profile information under the Missing Fields section.

-

If your company has implemented the Org Units Migration, the missing fields prefaced with HCM in blue, such as Class, Org Units, and Banking, will need to be added in the employee's HRIS profile.

-

If your company has not implemented the Org Units Migration yet, the missing fields prefaced with HCM in blue, such as Class, Org Units, and Banking, will need to be added in Namely Payroll.

-

Missing Fields prefaced with Payroll in green, such as Tax, can be added in Namely Payroll.

-

Add the Missing Fields

Refer to the below chart for instructions on how to add missing employee profile fields.

|

COMMON MISSING FIELDS |

INSTRUCTIONS |

|

Tax Information |

|

|

Banking Information |

|

|

Class Information |

|

|

|

Assigning Org Units (With Allocations) or |