Post-Open Enrollment Election and Deduction Audit

This manual provides a mechanism to validate that the benefits enrollment and deduction data on your employees' profiles match the elections and deductions you'd expect them to have after electing benefits during Open Enrollment. This report can be used to audit data after Open Enrollment is completed, and prior to your first payroll run with new enrollments

OVERVIEW

We recommend reviewing and auditing employee election and deduction data after your Open Enrollment is complete. Two reports in our Report Writer tool are best to review plan costs and deductions (and to compare them to make sure they match for all employees.)

-

Enrollment Report

-

Deduction Report

DOWNLOADING THE REPORTS

You can access templates for these two reports by going to Namely Payroll > Reports > Report Writer > Add, then selecting either Enrollment or Deduction from the Template list. You can add a Name and Description of your choosing.

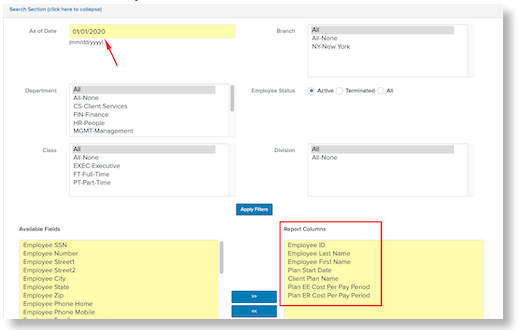

Enrollment Report

To successfully run the Enrollment Report, set the As of Date to 01/01/2021, and include the following fields in the report:

-

Employee ID

-

Employee Last Name

-

Employee First Name

-

Plan Start Date

-

Client Plan Name

-

Plan EE Cost Per Pay Period

-

Plan ER Cost Per Pay Period

After building the report, select Generate Report at the bottom of the screen. On the following screen, once your report is returned, you will have an option to Export to Excel. Once you export and open the report, you can view the relevant employee data and can begin auditing their Plan Benefits data.

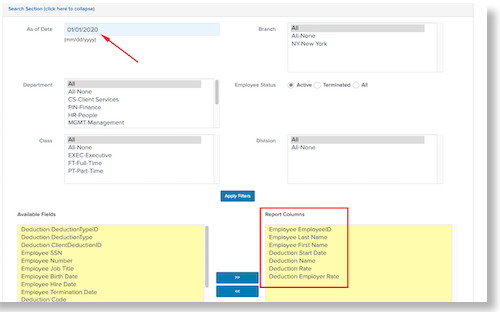

Deduction Report

To successfully run the Deduction Report, set the As of Date to 01/01/2020, and include the following fields in the report:

-

Employee ID

-

Employee Last Name

-

Employee First Name

-

Deduction Start Date

-

Deduction Name

-

Deduction Rate

-

Deduction Employer Rate

You'll want to follow the same steps detailed above to Generate and Export the Deduction Report to audit employee Deductions data. We also strongly recommend reviewing and comparing deduction amounts and plan costs, to ensure they match.