New Deduction Scheduling for Benefits

Our latest release makes changing the frequency of benefits deductions from employees’ paychecks more manageable than ever.

Want to keep employee deductions from applying to every pay cycle? Now manual suppressions and calculations are no longer required to change the frequency of deductions!

New scheduled benefits deductions in Namely allow you to align the frequency of paycheck deductions to other frequencies besides every scheduled pay date, helping you better meet your employees’ benefits and payroll needs—while also helping you stay in compliance with IRS limits on pre-tax deductions.

Note: The option for scheduling deductions is currently only available for the following:

-

Flexible Spending Account

-

FSA S125 Dependent Care

-

Health Savings Account - Self Only

-

Health Savings Account - Family

-

Section 132 Parking

-

Section 132 Transit

-

Post Tax Parking

-

Post Tax Transit

OVERVIEW

Namely’s new deduction enhancements:

-

Let you schedule benefit deductions from employees’ paychecks to occur at frequencies other than every pay cycle.

-

Recognize when deductions are not applied to every pay cycle and automatically calculate pay period deduction amounts for you.

-

Include new Post Tax Parking and Transit deductions to help ensure Pre Tax deductions aren’t putting you over maximum IRS limits.

-

Align your effective date for new deduction frequencies with your organization’s benefit plan year.

HOW IT WORKS

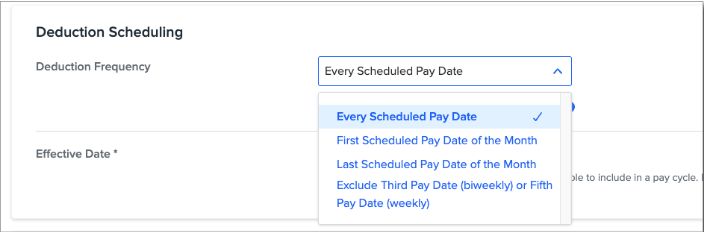

Our new deduction frequency options give you more flexibility when selecting how often to make deductions from employees’ paychecks, including:

-

Every scheduled pay date (default)

-

Only the first scheduled pay date of every month

-

Only the last scheduled pay date of every month

-

Or, you can opt to exclude deductions from

-

the third pay date of every month (for bi-weekly pay cycles)

-

the fifth pay date of every month (for weekly pay cycles)

-

LEARN MORE

Our latest benefits enhancements make it easier to ensure that your employees’ benefit deductions are accurate, compliant, and straightforward.

For complete instructions on how to set up and renew benefits using new deduction schedules, see our detailed how-to article Scheduled Benefit Deductions.