How can I add Domestic Partner Rates to my plans?

Some plans may allow Domestic Partners to enroll. In most instances, the portion rate that applies to the domestic partner and any domestic partner dependents is post-tax. Namely has the ability to split the taxation for these plans.

Domestic partner eligibility and the option to set a corresponding deduction can be found under Plan Settings in your Benefits Setup. To add a Domestic Partner Rate:

-

Click Manage Benefits from your homepage.

-

On the Benefits Setup landing page, select the plan you'd like to update.

-

On the next page, click Edit to enter the Plan Settings tab.

-

Check the box indicating if domestic partners are eligible for the plan or not. If you select yes:

-

Select whether only same-sex or same sex and opposite-sex partners are eligible.

-

Select whether children of domestic partners are eligible.

-

Select which post-tax deduction you'd like to map to.

-

Publish and Continue.

-

-

Go to the rates tab and enter your rate amounts.

The Plan Setup Assistant will automatically separate the pre and post-tax amounts from your total rate amount. You can view this on the Plan Summary page.

If you have not migrated your Benefits Administration platform to the Plan Setup Assistant, you can make updates to domestic partner rates in Namely Payroll.

-

In Namely Payroll, go to Enrollment Setup > Configuration > Plan > Edit Rate.

-

You can enter the post-tax rate in the Domestic Parter Monthly Rate column. Save your changes.

-

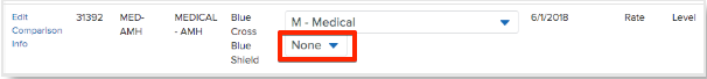

From the Plan page, select the appropriate deduction from the Domestic Partner deduction dropdown menu.