Commuter Over-Contributions

This article explains how to audit and address Commuter over-contributions, as well as tips on how to avoid potential over-contribution.

Resolving Commuter Over-Contributions

Audit the Data

The first step to addressing a Commuter over-contribution is to audit the data.

-

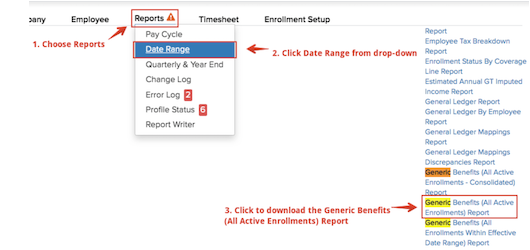

Pull a Generic Benefits (All Active Enrollments) Report in order to provide employees’ annual election information. Go to Namely Payroll > Reports > Date Range > Generic Benefits (All Active Enrollments) to download the file.

-

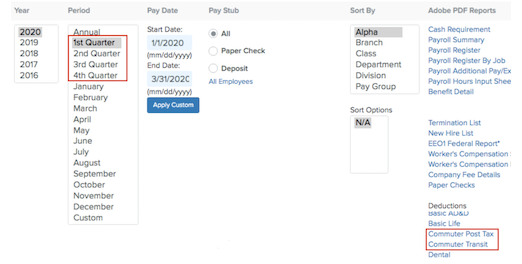

From the same screen, pull Deduction reports for Commuter Post Tax and Commuter Transit for every quarter that has occurred in the current year. These reports will provide you an overview of the Commuter contributions the employee has actually made in Namely Payroll. Combine the amounts from these quarterly files for Year to Date totals.

Download both reports and combine the quarterly data in the Deduction reportsto use the YTDs and identify any employees who have over-contributed. Once you identify the employee(s) in question:

-

You or your carrier may choose to allow employees to change their annual election (as long as it does not exceed the monthly or annual maximum set by the IRS for pre-tax contributions) to match their current YTD contributions. If this is the case, reimbursements (see below) would only be needed for employees that contributed over the IRS monthly or annual maximum (which would equal the difference of their YTD total minus the IRS maximum).

-

Compare current YTD totals to employees’ original plan volume elected (using the Generic Benefits Report); employees can be refunded the difference between their current YTD contribution and their plan volume (or IRS maximum, if applicable, if that’s what was elected).

Note: if you would also like to see a report to validate active employee deduction amounts, pull a Deductions Report in Namely Payroll > Reports > Report Writer. If there is already a Deductions Report in your Report Writer, make sure it's set to pull All employees, the Date As Of is current, and click Run.

Post-Tax Commuter Plans

Reimbursements

You are responsible for processing reimbursements for employees, which is usually with your next regularly scheduled payroll. Post-Tax deductions do not affect taxes or taxable wages and are not subject to IRS regulations.

-

If the adjustment falls in the current quarter and you haven’t end-dated the deduction on the employee profile:

-

Enter a negative deduction override in Step 2 of Payroll. This will adjust the YTD amount and refund the employee at the same time. End-date the deduction(s) on the employee profile once the payroll is processed.

-

Refer to this video: https://vimeo.com/428503006/9d5d3142cc

-

If the adjustment falls in the current quarter and you have end-dated the deduction on the employee profile:

-

Remove the end date, process the negative deduction override in Step 2 of payroll (shown above), then end-date the deduction once again on the employee profile.

-

-

If the adjustment falls in prior quarters:

-

Provide a breakdown of amounts to be backed out per quarter so that our team can make the adjustment on the back end. Refund the employee by using a Reimbursement - Non Taxable earnings code

-

Refer to this video: https://vimeo.com/428504507/f9483232a4

If you need assistance or have questions about the process, submit a case in the Help Community and include any details from your investigation, including affected employees and over-contribution amounts.

Tax Implications

Since Post-Tax Commuter deductions do not affect taxes or taxable wages, there are no tax implications.

Pre-Tax Commuter Plans

Reimbursements

You are responsible for processing reimbursements for employees, which is usually with your next regularly scheduled payroll.

-

If the adjustment falls in the current quarter:

-

Submit a case in the Help Community to process a void/reissue/reimbursement. When backing out a pre-tax deduction, the monies become taxable and taxes will calculate. The over-withheld pre-tax deduction minus the tax liability will determine the amount you should refund using the Reimbursement - Non Taxable earnings code.

-

Refer to this video: https://vimeo.com/428504507/f9483232a4

-

If the over withholding occurs in prior quarters:

-

Submit a case in the Help Community and provide a breakdown of amounts to be adjusted (backed out) per quarter. Once the adjustments are made, review the payroll reports to see the calculated tax liability. Take the over-withheld deduction amounts minus the tax liability that was calculated, and the difference is the amount you should refund using the Reimbursement - Non Taxable earnings code (shown above).

-

If you need assistance or have questions about the process, submit a case in the Help Community and include any details from your investigation, including affected employees, over-contribution amounts, etc.

Tax Implications

Pre-Tax Commuter deductions affect taxes and taxable wages so if the over-contributions occurred in prior quarters, Amendments (and possibly W-2c’s) will be needed. Submit a case in the Help Community for a resolution.

Common Causes and Prevention Tips

Common causes for an over-contribution include, but are not limited to:

-

Missing pay cycles during client’s plan year causes the Benefit Wizard to miscalculate per pay period deductions.

-

Manual changes to plans/deductions.

-

Plan anniversaries that aren’t on the calendar year causes Namely Payroll unable to cap the amount during the middle of the year.

Over-contributions can be prevented with proper testing of the Benefit Wizard. Be sure to thoroughly test and check pay period calculations for these benefits.

Namely recommends conducting regular deduction and contribution audits using the process detailed above to over-contributions, especially when the plan year is not on the calendar year. It’s best to audit before processing your last payroll of the plan year.