COVID-19 Section 125 Cafeteria Plan Updates

This article highlights the Section 125 Cafeteria Plan updates and provides information on managing benefit changes in Namely.

Overview

On May 12, 2020, the IRS announced temporary updates to its Section 125 Cafeteria Plan policy to provide employees with flexibility to make some benefits changes in light of the COVID-19 pandemic.

Mid-Year Election Changes to Section 125 Cafeteria Plans

-

You may change or waive an election for Medical, Dental, Vision, Health Savings Account (HSA), Medical Flexible Spending Account (Medical FSA), or Dependent Care Flexible Spending Account (Dependent Care FSA) in the middle of the plan year without having experienced an IRS-approved qualifying event.

-

Mid Year election changes for medical, dental, and vision are subject to the carrier.

-

-

Note: You can change your election going forward, but you will not be able to receive a refund for any previous contributions.

-

Please see IRS Notice 2020-29 for more information.

Medical FSA Carryover

-

The Medical FSA carryover maximum increased from $500 to $550 and will be indexed for inflation. If your plan has a carryover today of $500, your carrier will automatically update your carryover to the new maximum of $550.

-

Medical FSA carryover increase to $550 only applies to 2020 plans. For example, 8/1/19 FSA still has a $500 carryover.

-

-

Please see IRS Notice 2020-33 for more information.

Managing Benefit Changes in the Namely System

Updating Enrollments via the Enrollment Wizard

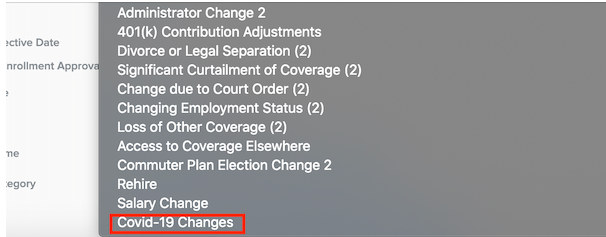

Enrollments can be updated using the Administrator Change life event or by using the new COVID-19 Changes life event.

We recommend reaching out to your broker or carrier to confirm they're prepared to process a COVID-19-related life event before making any changes.

-

For information on processing changes with an Administrator Change, refer to our Administrator Change Process Guide.

-

If you would like to grant employees the ability to make these changes on their own, you'll need to add the COVID-19 Changes life event via Namely Payroll > Enrollment Setup > Configuration > Life Events > Add.

Refer to our article titled Creating Life Events to set up the new life event. Once you have created your new life event, you'll want to map the appropriate coverages to the event to ensure employees are offered the correct plans for changes. See Creating and Mapping Coverage Lines for more information.

Things to consider when changing Medical FSA or Dependent Care FSA enrollments:

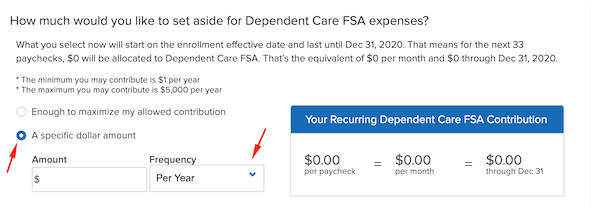

On the Medical FSA or Dependent Care FSA pages in the Enrollment Wizard, select A specific dollar amount, and change the Frequency drop down to Per Year

-

To eliminate any future contributions:

-

Enter the plan year-to-date contributions amount.

-

For example, if you had a May 1, 2019 Dependent Care FSA and a May 1, 2020 Dependent Care FSA. Your plan year-to-date contributions would include contributions from May 1, 2019 through April 30, 2020.

-

-

To increase or decrease (but not completely eliminate) any future contributions:

-

Calculate the amount that you contributed YTD, then add or subtract any additional or fewer FSA dollars.

-

For example, if you contributed $50 per paycheck for four paychecks, you would have contributed $200 YTD. If you would like to add $1,000 in your account for the rest of the year for a total of $1,200 for the plan year, you would enter in $1,200 as the amount per year. If you would like to decrease your election by $50, you would enter $150 (i.e., the YTD of $200 minus the $50 reduction).

-

Updating Deductions for HSA, Medical FSA, and Dependent Care FSA

After new enrollments for HSA and/or FSA have been confirmed, there are a few additional steps that must be taken to ensure the plans are updated correctly.:

-

Go to the employee’s Deductions page in Namely Payroll.

-

Locate any updated HSA or FSA plans, and click Edit.

-

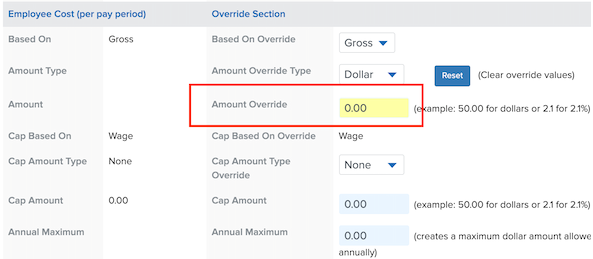

Update the deduction amounts as follows:

-

For HSA accounts:

-

If the employee has eliminated future HSA contributions, enter $0 in the Amount Override section.

-

Note: If the employee entered their current YTD amount into the desired volume when they processed their life event, this would indicate that the employee’s intention was to eliminate future contributions.

-

-

-

If the employee has increased or decreased (but not eliminated) future HSA contributions, no additional action is needed.

-

For Medical or Dependent Care FSA accounts:

-

If the employee has eliminated future FSA contributions, enter $0 in the Amount Override section.

-

Note: If the employee entered their current YTD amount into the desired volume when they processed their life event, this would indicate that the employee’s intention was to eliminate future contributions.

-

-

If the employee has increased or decreased (but not eliminated) future FSA contributions, enter in the value resulting from the following calculation: (Employee’s new election - contributions YTD) / Number of pay periods left in the year),

-

Note: If the employee entered in a value above the YTD contribution, this would indicate that the employee’s intention was to increase their election.

-

-

FAQs

What plans are employees allowed to update with these temporary changes to Section 125 Cafeteria Plans?

Employees are allowed to change plans that qualify as Section 125 Cafeteria Plans as detailed by the IRS - typically: Medical, Dental, Vision, Health Savings Account (HSA), Medical Flexible Spending Account (Medical FSA), and Dependent Care Flexible Spending Account (Dependent Care FSA). Please review the policies directly with your broker or carrier to confirm carrier specific rules and regulations.

How should my employees make any desired changes to their enrollments?

While you can make changes on an employee’s behalf using an Administrator Change life event, Namely recommends adding the COVID-19 Changes life event and mapping the Section 125-eligible plans to the life event. For more information, see Creating Life Events and Creating and Mapping Coverage Lines.

Is any action required on Namely’s end due to the increase in FSA carryover limits?

No. No further action is needed on Namely’s end, and no action in the Namely system is required of you; your FSA carrier will be handling this.