Payroll Register Reports

The Payroll Register reports give a snapshot of employee’s individual checks. Payroll Register reports do not show information based on departments worked, but rather on employee home departments. All of the Payroll Register reports allow for batch processing.

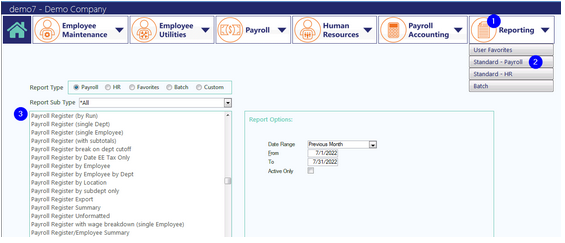

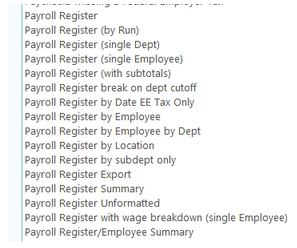

Payroll Register Reports are located under the Reporting tab in CertiPay. As you can see from the screenshot below, there are 16 Payroll Report options and a description of each one is listed below.

Where to Locate:

Reporting > Standard – Payroll > Scroll to find Payroll Register.

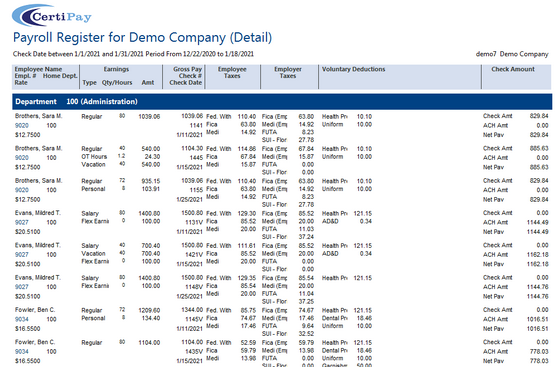

Payroll Register

Information on this report is grouped in sections of Employee Information, Earning Information, Gross Pay and Check Information, Employee Taxes, Employer Taxes, Voluntary Deductions, and Check Amount (Net Pay).

This report is sorted alphabetically by employee last name within home departments assigned on employee profiles, and it contains the following fields:

|

Employee Information Section: |

|

|

Employee Name |

|

|

Empl. # |

Employee number |

|

Rate |

Employee’s primary rate of pay, as indicated on the General tab in the employee’s Payroll Profile under Employee Maintenance |

|

Home Dept. |

Employee’s home department, as indicated on the Departments tab in the employee’s Payroll Profile under Employee Maintenance |

|

Earning Information Section: |

|

|

Earnings Type |

Earning code the employee’s hours/amounts are being paid under (Regular, Salary, PTO, etc.) |

|

Earnings Qty/Hours |

Number of hours or quantity being paid under the Earning Type |

|

Earnings Amt |

Total amount being paid under the Earning Type |

|

Gross Pay and Check Information: |

|

|

Gross Pay |

Total of all Earning Amounts |

|

Check # |

Number on check or voucher issued to employee (if the number is followed by a V, this indicates this is a voucher and the net amount was direct deposited). |

|

Check Date |

Pay date |

|

Employee Taxes Section: |

|

|

Individual listing of all tax amounts withheld from employee(s) on the current check. Examples of items shown here are Federal Income Tax Withholding, Employee FICA/Social Security, Employee Medicare and State Income Tax Withholding, among others |

|

|

Employer Taxes Section: |

|

|

Individual listing of all tax amounts paid by the employer on the current check. Examples of items shown here are Employer FICA/Social Security, Employer Medicare, Federal Unemployment Tax (FUTA) and State Unemployment Tax (SUI), among others |

|

Voluntary Deductions Section: |

|

|

Individual listing of all other deduction amounts withheld from employee(s) on the current check. Examples of items shown here are Medical Insurance, other benefit insurance deductions, Uniforms, Employee Loan repayments and Garnishment deductions, among others |

|

|

Check Amount Section: |

|

|

Net Pay amount is listed in this section, along with an indication of whether the employee was paid via direct deposit (ACH Amt) or live check (Check Amt) |

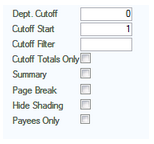

This report has the following options on the main report screen:

|

Dept Cutoff |

Cutoff fields allow you to view only employees in certain departments; this field would indicate the number of characters to use as the cutoff |

|

Cutoff Start |

Cutoff fields allow you to view only employees in certain departments; this field would indicate the digit to start showing on the report |

|

Cutoff Filter |

Cutoff fields allow you to view only employees in certain departments; this field is used to only display specific numbers within the filter |

|

Cutoff Totals Only |

Cutoff fields allow you to view only employees in certain departments; if checked, the report will not display department numbers, it will show all employees that fall within the filter as if they are all in the same department. No department subtotals will show, only grand totals at the end of the report |

|

Summary |

Check box to hide individual employee information and only show company totals |

|

Page Break |

Check box to insert a page break in the report for each department |

|

Hide Shading |

Check box to remove highlighting from report |

|

Payees Only |

Check box to show information for Garnishment Payees only |

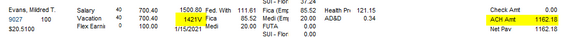

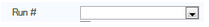

Sample Report View:

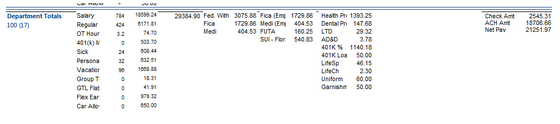

Each department has subtotals for all items indicated above at the end of the employee listing.

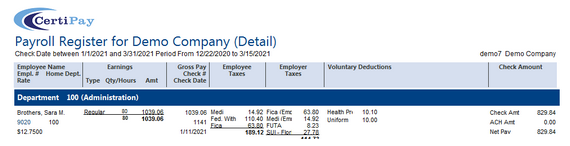

Sample Report View:

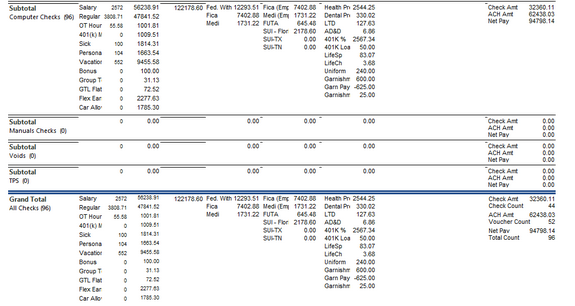

Company subtotals are displayed at the very end of the report. This includes information on manual checks and voided checks along with company totals for all departments and all employees.

Sample Report View:

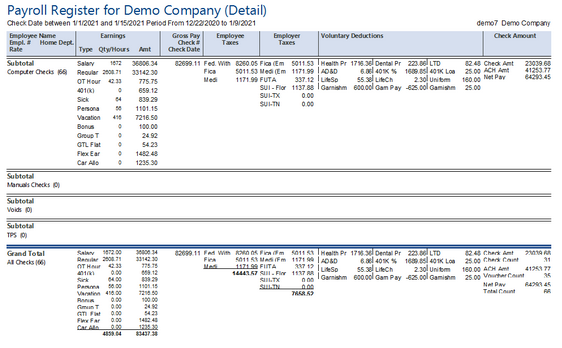

Payroll Register (by Run)

This report is sorted the same as and contains the same data fields as the Payroll Register report above. It differs from that report in that the Cutoff Filter is not a report option, and the data to view is chosen by Payroll Run Number rather than a date range.

This report has the following options on the main report screen:

|

Run # |

The Payroll Run Number to display information on must be selected from this dropdown. |

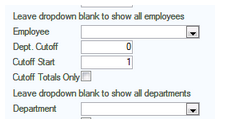

Payroll Register (single Dept)

This report is sorted the same as and contains the same data fields as the Primary Payroll Register (Payroll Register by Run). It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, and the data displayed is for a single department.

This report has the following options on the main report screen:

|

Department |

The Department to display information on must be selected from this dropdown. |

Payroll Register (single Employee)

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, and the data displayed is for a single employee.

This report has the following options on the main report screen:

|

Employee |

The Employee to display information on must be selected from this dropdown. |

Payroll Register (with subtotals)

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Cutoff Filter is not a report option, and subtotals are calculated both at the employee level and on the company totals for Earnings, Employee Taxes and Employer Taxes.

Sample Report View:

Payroll Register break on dept cutoff

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Cutoff Filter is not a report option. This report is typically used to group employees together based on the Dept. Cutoff and Cutoff Start report options along with the Cutoff Totals Only report option.

Payroll Register by Date EE Tax Only

This report is sorted the same as and contains most of the same data fields as the Primary Payroll Register. It differs from that report in that it does not include employer taxes on the report, and the Cutoff Filter is not a report option.

This report has the following options on the main report screen:

|

Employee |

Select an individual employee to view data on, if applicable. |

|

Department |

Select an individual department to view data on, if applicable. |

Note:If both of the above dropdowns are left blank, the report will display all employees and all departments. |

|

Payroll Register by Employee

This report contains the same data fields as the Primary Payroll Register. It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, it is sorted alphabetically instead of by department, and a totals line is displayed for each employee.

Payroll Register by Employee by Dept

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, and a totals line is displayed for each employee.

Payroll Register by Location

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that it is sorted alphabetically by home department as well as by the location each employee is assigned to on the employee profile.

Payroll Register by subdept only

This report is sorted the same as and contains the same data fields as the Payroll Register (Single Employee) report. It differs from that report in that it does not display a totals line for each employee.

Payroll Register Export

This report was designed to be able to break down the check information into an excel format, per employee. The report includes a breakdown of wages and deductions per item.

Sample Report View:

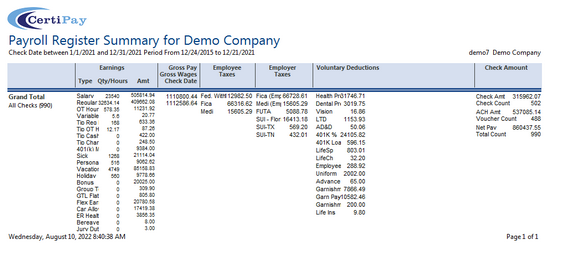

Payroll Register Summary

This report contains only the Grand Company Totals from the Payroll Register. There is no department or employee level detail on this report.

Sample Report View:

Payroll Register Unformatted

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, and all on screen formatting is removed from this report.

Payroll Register with wage breakdown (single Employee)

This report is sorted the same as and contains the same data fields as the Primary Payroll Register. It differs from that report in that Dept. Cutoff, Cutoff Start, Cutoff Filter and Cutoff Totals Only are not report options, the earnings column contains the rate paid for each earning and a single employee can be chosen to view data on.

This report has the following options on the main report screen:

|

Employee |

The Employee to display information on must be selected from this dropdown. |

Payroll Register/Employee Summary

This report contains the same data fields as the Primary Payroll Register and is a combination of the Payroll Register report broken down by employee and the employee summary report. This report has added the employee summary information, including employee SSN, race, DOB, original hire date, title, job clock, pay cycle, address, gender, rate of pay and phone number.

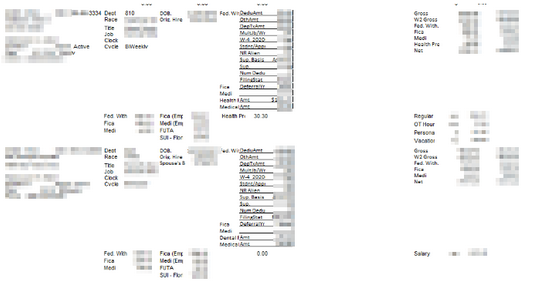

Sample report view: