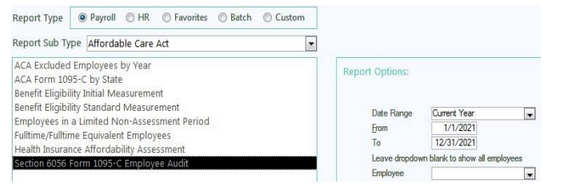

How to use the ACA Section 6056 Form 1095-C Employee Audit Report

The Section 6056 Form 1095-C Employee Audit report is a great tool to use to verify that you have entered all the required data for ACA reporting prior to CertiPay generating and printing employee Forms 1095-C.

CertiPay tips that may be helpful when reviewing the audit report:

Make sure to enter the period dates for the entire calendar year

The report will separate your employees by their Department and the Employee Type on their profile – Fulltime/ Parttime/ Variable Hour/ Seasonal/ Ect.

-

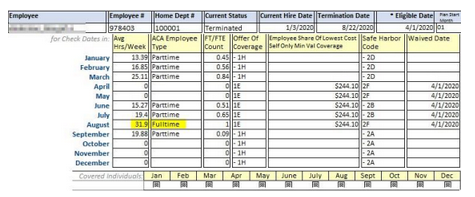

Keep in mind: Whether or not an employee receives a Form 1095-C is dependent on their hours worked – not the Employee Type on their profile

Employees will receive a Form 1095-C based on their ACA Employee Type – this is determined based on average hours worked

-

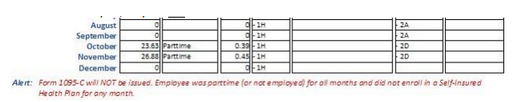

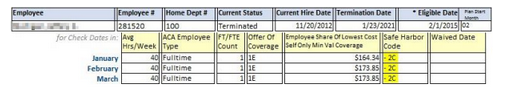

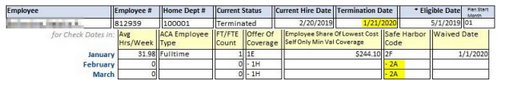

If an employee has ACA Employee Type: Parttime for all months employed during the calendar year, they will not receive a Form 1095-C.

-

Based on IRS regulations, if an employee averages Fulltime hours for any month, they will receive a Form 1095-C – even if they are a Parttime employee averaging <30 hours/week overall. (This does not necessarily mean that you must offer that Parttime employee benefits.)

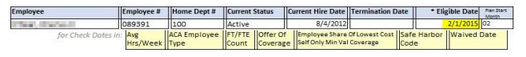

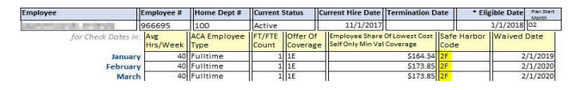

All employees who are currently eligible for benefits must have their Eligible Date populated in the

*Eligible Date field located on the Payroll Profile, without this date the code 2D (waiting period) cannot be applied to the employees 1095-C

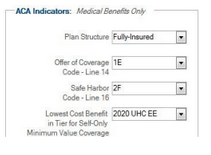

Any employee who is eligible for benefits must have either Safe Harbor Code 2C (enrolled in coverage) or the Safe Harbor Code for an unaccepted offer you have set up on your medical benefits (2F, 2G, 2H)

-

Enrolled coverage –

-

Waived coverage – 2F (as example, can also be 2G or 2H based on the ACA indicators setup)

- Based on IRS regulations, the Employee Share of Lowest Cost Self Only Min Value Coverage field will not be populated with the employee’s monthly contribution if you selected Offer of Coverage Code 1A

-

By selecting Offer of Coverage Code 1A you are already indicating that your plan is <% of the single Federal Poverty Line set by the IRS per year, so the employee’s monthly contribution amount is not necessary.

If an eligible employee has terminated, Safe Harbor Code 2A (employee is not employed) should be populated after the month of termination. If that code is not populated, then you must go to the employee’s HR profile > Benefits and update the Termination Date on their enrolled or waived benefit as well as the employee history.

Offer of Coverage Code* – Line 14, please review IRS codes to help determine which coverage code to use.

Safe Harbor Code* – Line 16, please review IRS codes to help determine which coverage code to use.

-

Safe Harbor Codes 2E – 2I are COMPANY LEVEL codes.

-

Safe Harbor Codes 2A – 2D are EMPLOYEE LEVEL codes that will override the COMPANY LEVEL standard code based on ACA regulations.

Overview of reports located within the Employee Audit Report:

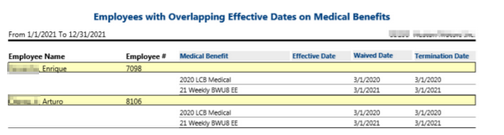

Four additional reports can appear following closing the report, those reports include the MEC Coverage Calculation, Transmittal Info and Audit Summary, ACA Employees Eligible for Medical with No Offers of Coverage and Employees with Overlapping Effective Dates on Medical Benefits.

-

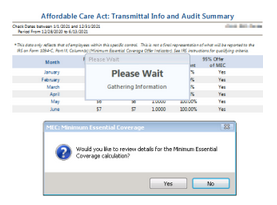

When initially running the Section 6056 Form 1095-C Audit, the report will ask if you would like to review the Minimum Essential Coverage calculation, always say yes.

-

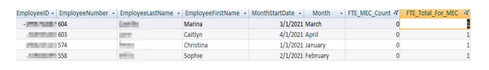

After closing the initial report, the MEC coverage report will appear that looks similar to a spreadsheet listing all employees. If you would like to determine which employees are lowering the MEC based on a monthly basis, the report can be filtered as 0 for ‘FTE_MEC_Count’ and 1 for ‘FTE_Total_For_MEC’. This identifies the corresponding individuals who are lowering the overall MEC that will be reflected on the transmittal info and audit summary.

-

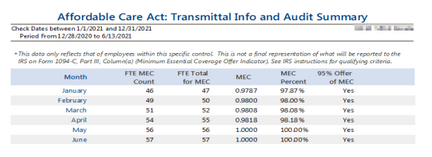

Following the close of the MEC coverage calculation report, the ‘Affordable Care Act: Transmittal Info and Audit Summary’ report will show what the MEC % that will determine if the company will be marked YES or NO for each month on the 1094-C. The goal should be to always achieve over 95% for each month.

-

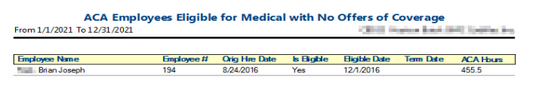

If employees are marked eligible but do not have enrolled or waived benefits indicated on their HR profile for the entire period they worked, they will show on the ‘ACA Employees Eligible for Medical with No Offers of Coverage’ report once the previous report is closed. Each employee will need to be reviewed and updated.

-

Once the report above is closed, if there are employees with overlapping dates on their medical benefit, they will appear on the ‘Employees with Overlapping Effective Dates on Medical Benefits’ to indicate employees effective date(s), waive date(s) and termination date(s) that need to be reviewed so there are no longer coinciding dates.

If you have any specific questions when review the audit report, contact ClientServices@certipay.com,and a representative will be able to assist you.