Procedure for Confirming Existence Name Change FEIN - J. Duffy

Procedure For Confirming Company Existence, Name Change, and FEIN

There has been some confusion as to what is necessary to verify/confirm a company’s existence, a name change, and/or verify an FEIN. Below are the only documents we should be accepting:

-

Verification of existence – Articles of Incorporation

-

Can be found through the Secretary of State in the state in which the company was incorporated. Typically available on the Secretary of State’s Website through a business entity search. See hyperlinks below.

-

-

Name Change – Official name change documentation from Secretary of State in the state in which the company was incorporated.

-

Should also be available through a business entity search.

-

Be careful not to confuse a name change with a new company formation. A name change will not involve a new FEIN. A new company formation will.

-

If a client says they have changed their name you MUST verify that there is an actual name change (including old name and new name) documentation and it has been properly filed with the state in which the client was incorporated. If there is not, do a search for the new name. If the new name comes up separately and is in no way linked (on the Secretary of State’s Website) to the old name, it is very likely that the client did not simply change names, they formed a new corporation.

-

If a new corporation has been formed, a new control must be created and the old control must be deactivated.

-

The history should NOT transfer to the new control, as it is not the same company.

-

-

D.B.A (Doing Business As)

-

A d.b.a. differs from a company in that it allows an individual or company to do business with the public under a fictitious name. Example – Raysway, Inc – d.b.a. McDonald’s. Raysway, Inc. is the legal name of the company doing business as McDonald’s in multiple locations in the Winter Haven area.

-

When processing payroll, we should always use the legal entity name and not the d.b.a. It is ok to include the d.b.a. on documentation, including checks, but a d.b.a. should not take the place of a company name.

-

Documentation of d.b.a. can be found with each state’s Secretary of State, as will corporate filings.

-

The d.b.a. documentation must include the name and FEIN of the company it is related to.

-

-

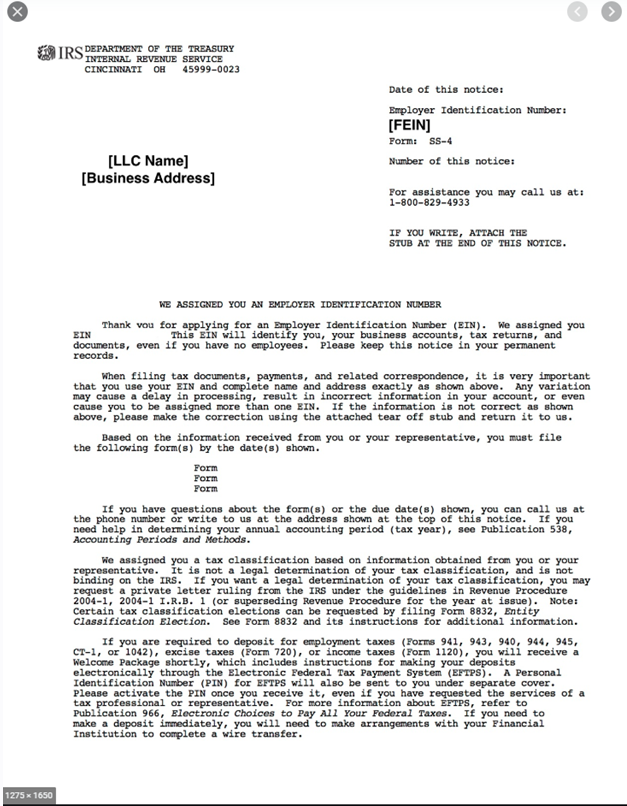

Verification of FEIN – IRS FEIN Assignment Letter (See example below)

-

If the client does not have the FEIN Assignment Letter, they will need to do two things

-

Call the IRS and request a replacement letter – 800-829-4933, select 1 for English, 2 for Spanish – then select option 1 and then option 3. Ask the IRS Representative to send a replacement FEIN Letter. Once received, the client MUST send a copy to Certipay.

-

Provide, on a temporary basis, a previously filed IRS tax return showing the name of the company and the FEIN. All financial information may be redacted. The entire return is not necessary. The client need only provide the first page of the return that shows both the company name and the FEIN.

-

-

If the client does not have an FEIN they must:

-

Complete an IRS Form SS-4 and submit to the IRS (https://www.irs.gov/pub/irs-pdf/fss4.pdf)

-

Provide CertiPay a copy of the application while awaiting the FEIN Assignment letter.

-

-

It is very important to verify that the name on the Article of Incorporation/Name Change documentation match the name on the IRS FEIN Assignment Letter. If the names do not match, they may not belong to the same company. The business entity type must also be the same (Inc, LLC, LLP, etc).