Preparing for Year-End 2022

Year-End For Payroll Professionals

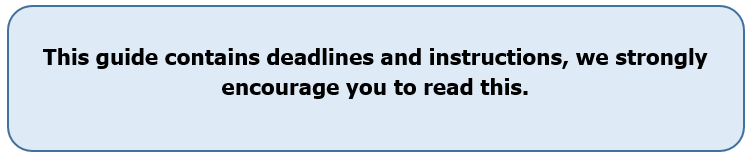

Payroll Year-End can be a busy time and we want to make sure that your Year-End is as trouble-free as possible. We are offering tips and reminders in order to give you a head start to help avoid delays and streamline your Year-End process. This guide provides you with some basic Year-End information which we hope you will find helpful.

-

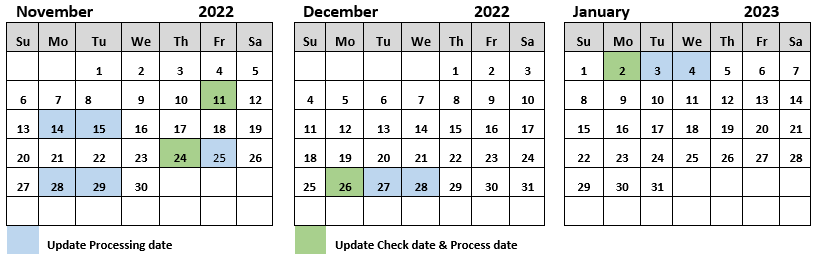

Year-End Checklist – Reminders for Your Last 2022 Payroll

-

Year-End Calendar – Important Dates & Deadlines

-

Tips For Verifying W-2, 1099, & Tax ID Information

-

4th Quarter End Notice – Information About Processing Your Final Payroll

-

ER Healthcare Requirements – Information You Need To Know

-

Year-End Adjustments – Frequent Year-End Adjustments

-

Third Party Sick & Fringe Benefits - Helpful Things You Need To Know & Reminders

-

Year-End Processing Definitions / Explanation of W-2 Earnings

-

W-2 Address Verification – Information Needed for Timely W-2 Deliveries

-

Preparing For 2023

We also want to make certain that you are aware of our policy regarding Year-End adjustments made after your last payroll of 2022. Any changes made after December 30, 2022, may require us to reprocess your Year-End returns and W-2 information. These reprocesses will incur additional processing charges.

Any changes made after Year-End forms have been finalized may require amended forms. The amended forms will not be completed until after the month of February at a cost of $300 per Amendment and $85 each/per form (W-2C & W-3C).

THEREFORE, IT IS CRUCIAL THAT YOU REVIEW YOUR 2022 YEAR-END ITEMS FOR ANY ADJUSTMENTS NEEDEDBEFORE YOU PROCESS YOUR LAST PAYROLL.

READ DISCLAIMER CAREFULLY:

This guide, in its entirety, is intended for informational purposes ONLY. All information published herein is gathered from sources which are thought to be reliable, but the reader should not assume that the information is official or final. CertiPay does not assume responsibility for errors or omissions. All information and fees are subject to change without notice. For further explanation of any topics referenced within this guide,please contact your CPA or legal advisor, as CertiPay does NOT provide wage, tax , legal advice, or otherwise. This guide cannot be reproduced without written permission.

Year-End Checklist – Things to keep you on track

Please use this checklist to assist with items that may need to be considered when processing your last scheduled payroll:

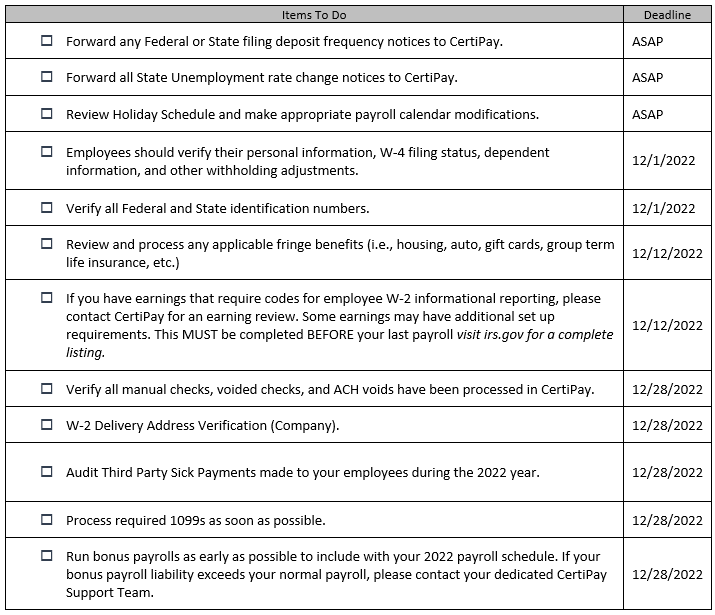

Important Dates & Deadlines

Bank Holiday Schedule: Banks are closed.

If your normal check date falls on the following dates, you MUST adjust your payroll calendar to reflect one business day before or after the date listed below. If your payroll is PROCESSED on the dates listed below you MUST adjust your process date to accommodate the 2 Day bank processing requirement.

Veterans’ Day: 11/11/2022

Thanksgiving Day: 11/24/2022

Christmas Holiday: 12/26/2022

New Year’s Holiday: 1/02/2023

CertiPay Holiday Schedule: CertiPay Offices are closed.

Holiday check processing deadline is no later than 12 PM, 2 Days prior to the Holiday to ensure that check printing and deliveries are not delayed for the following dates:

Thanksgiving Holiday: 11/24/2022 & 11/25/2022

Christmas Holiday: 12/26/2022

New Year’s Holiday: 01/02/2023

If your offices will be closed and you need to make alternate delivery arrangements, please contact your dedicated CertiPay Online Support Team.

CertiPay Year-End Deadlines

RECOMMENDED Early 2022 Year-End Adjustments: 12/16/2022

FINAL 2022 Year-End Adjustment: 12/30/2022

Last Payroll PROCESSING Date: 12/28/2022

Last Payroll CHECK Date: 12/30/2022

The below highlighted boxes represent possible check dates. If your check date is blue, you must adjust your processing day. If your check date is green, you must adjust your processing and check date.

Late Year-End Adjustments Processing Information and Fees

Additional Year-End adjustment processing fees will be assessed if adjustments are not processed in accordance with the deadlines that are provided in the Year-End Calendar: Important Dates and Deadline section on page 4.

Year-End forms will be finalized after the deadline dates listed above; any changes needed beyond the deadline will require amended forms. The amended forms will not be completed until after the month of February at a cost of $300 per Amendment and $85 each/per form (W-2C & W-3C).

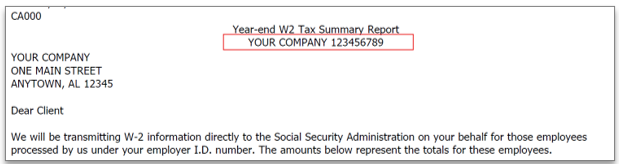

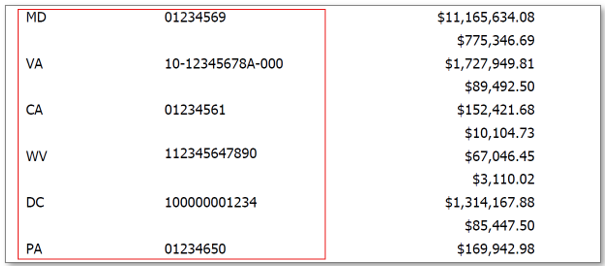

Tips for Verifying W-2, 1099, & Tax ID Information

In order to ensure accurate W-2, 1099, and Tax Return filing information, you should review and verify the data that you have provided to CertiPay Online is correct. Review the Federal and State ID information on your Interim W-2 Tax documents found in the documents under the reports section in the left hand panel (provided mid-November). If any of the information is incorrect, please notify CertiPay Online as soon as possible. This information must be updated prior to your last payroll for 2022.

Tip:

Your Federal ID number can be found at the top of page 1 on the Interim W-2 Tax Summary Report.

Tip:

The Interim W-2 Tax Summary Report lists applicable State reporting details that include State ID numbers. If an ‘Applied For’ description is listed, please submit the State ID number to CertiPay as soon as possible for accurate reporting.

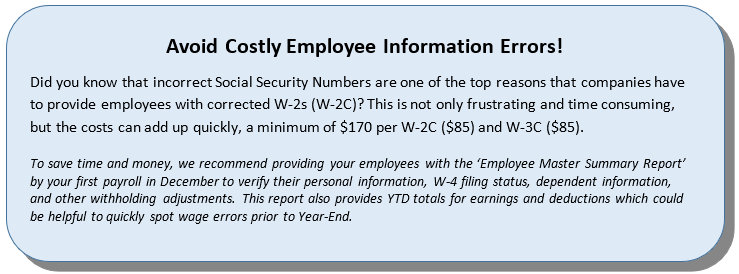

W-2 / 1099 Information Review

This is an important Year-End review step that will help you avoid not only the inconvenience, but the extra costs due to requesting a W-2C for easily prevented errors. A useful time saving option available to let your employees verify their profile information is providing them with a copy of the ‘Employee Summary Report’. This option allows your employees to quickly review their information and to provide you with any corrections needed prior to receiving their W-2.

Make sure your employees verify the following:

-

Is their social security number correct?

-

Do they have a current mailing address listed?

-

Have they had a name change or do they notice spelling errors?

Reminder: To ensure that your employee information updates are included on Year-End tax forms, all corrections must be made before processing your final payroll of the year.

4th Quarter End Notice – Information About Processing Your Final Payroll

The 4th quarter of 2022 will end on December 31st. In order to process your quarterly returns in a timely manner, please plan to make all adjustments, including manuals and voids, PRIOR to your last regular payroll run for the quarter.

Processing Your Final 4th Quarter Payroll Checks

When processing your final payroll checks for the 4th quarter, please keep in mind that all checks dated from October 1st to December 31st are considered 4th quarter entries.

December 28th is the last processing day for which 4th quarter tax filings can be made.

All 4th quarter items must be entered before processing a 2023 1st quarter check date (January 1st). Please note that any adjustments made after the quarterly returns have been processed, which often result in amended returns, will generate additional charges.

Additional Year-End Final Payroll Guideline Items

Bonus Payroll Runs:

When processing a bonus payroll that EXCEEDS YOUR NORMAL PAYROLL LIABILITY could cause funding delays due to banking requirements. Some clients may need to wire in funds depending on the amount of the bonus payroll. Please contact CertiPay to plan when transmitting a payroll that exceeds your normal liability.

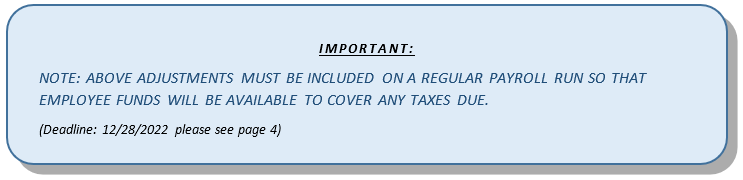

Year-End Adjustments:

All Year-End adjustments and special processing for items not previously entered such as Voided/Manual Checks. Fringe Benefits, 401(k) Refunds / Adjustments, Group Term Life (not previously calculated), Auto Allowance, Gift Cards, Moving Expenses Taxable/Non-Taxable, Dependent Care, Non-Qualified Plan, etc. MUST be transmitted no later than your last payroll for 2022.

Third Party Sick Pay/Disability Benefits

Employees with Third Party Sick Pay/ Disability Benefits that need to be included on the W-2 processed by CertiPay, MUST be recorded no later than 12/28/2022. If you receive notification for 4th quarter payments after Year-End, please contact CertiPay IMMEDIATELY for assistance. Please see Third Party Sick Pay & Fringe Benefits section for more details.

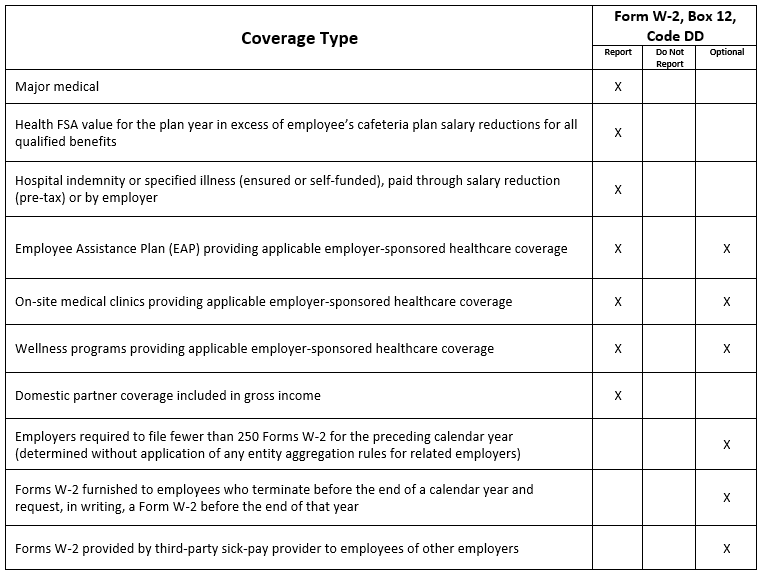

ER Healthcare Requirements – Information You Need To Know

The Affordable Care Act requires employers to report the cost of coverage under an employer sponsored group health plan on the 2022 W-2 form (box 12DD). This requirement is mandatory only for companies that issued 250 or more W-2s for the 2021 tax year.

If your company is required to report the cost of coverage under an employer sponsored group health plan and you do not have the required information set up in CertiPay, please contact us IMMEDIATELY.

Form W-2 Reporting Of Employer-Sponsored Health Coverage

This is a condensed version of a chart that can be used to help determine which employer health benefits should be reported on Form W-2 in box 12 using code DD. The full version can be found at irs.gov.

Year-End Adjustments – Frequent Year-End Adjustments

Please adhere to the guidelines below to ensure your 2022 Year-End runs smoothly and to avoid W-2 corrections.

Year-End Adjustments

Please review your payroll information closely and make ALL Year-End adjustments, missing wages or miscellaneous Income/Tax Credits, and special processing for items not previously entered such as:

-

Manual Checks/ Voided Checks/ ACH Voids

-

Group Term Life insurance in excess of $50,000 (not previously calculated)

-

Third Party Sick Pay

-

401(k) Refunds/Adjustments

-

Fringe Benefits

-

Personal Use of a Company provided vehicle

-

Auto Allowance

-

Gift Cards

-

Moving Expenses

-

Dependent Care

-

Non-Qualified Plan

-

Accident/health premiums for 2% or more for shareholders in a S Corporation

-

Employer paid education not related to their job

-

Value of certain awards and prizes

-

Non-accountable business expense reimbursements

-

Country club and health club dues

-

Allocated tips

-

Other – FSA / HSA Employer Contributions

Third Party Sick & Fringe Benefits- Helpful Things You Need To Know & Reminders

Third Party Sick Pay

Federal law requires the reporting of sick pay payments made to employees from a third party provider, as well as any taxes withheld on those payments. These payments must be included on the employee’s W-2 Form.

-

Please verify with your carrier if they are furnishing the W-2. Otherwise, the amounts MUST be entered on the W-2 CertiPay is processing.

-

Most carriers provide employee payment information online. Contact your carrier to verify if access to online payment information is available.

-

Contact for CertiPay Online Support Team as soon as Third Party Sick payment information becomes available.

Fringe Benefits

The Tax Reform Act of 1984 mandated that the value of certain non-cash fringe benefits be reported on the 941 and the employee’s W-2. Taxable Fringe Benefits are included as wages, making them subject to Federal Income Tax, FICA, FUTA and possibly some State Income and Unemployment Tax.

Examples of two common Fringe Benefits include Personal Use of Auto and Group Term Life Insurance* Reporting. The Internal Revenue Service has issued regulations defining what is considered a Taxable Fringe Benefit and how to arrive at its value. If you require advice on this, please contact your CPA, as CertiPay does not provide advice on this matter.

*GROUP TERM LIFE INSURANCE: Please report the value of group-term life insurance in excess of $50,000 before your last payroll of the year.

Year-End Processing Definitions / Explanation of W-2 Earnings

Deferred Compensation / Retirement Plan

The W-2 requires that a box be checked for employees who are active participants in a retirement plan. Generally, an employee is an active participant if covered by either of the following:

-

A defined benefit plan for any tax year that he or she is eligible to participate in, or

-

A defined contribution plan (for example, a section 401(k) plan) for any tax year that employer or employee contributions (or forfeitures) are added to his or her account.

For additional information on employees who are eligible to participate in a plan, contact your plan administrator. For details on the active participant rules, see Notice 87-16, 1987-1 C.B. 446, Notice 98-49, 1998-2 C.B. 365, section 219(g)(5), and Pub. 590, Individual Retirement Arrangements (IRAs).

You can find Notice 98-49 on page 5 of Internal Revenue Bulletin 1998-38 at www.irs.gov/pub/irs-irbs/irb98-38.pdf. Per the instructions, check this box if the employee was an “active participant” (for any part of the year) in any of the following:

-

A qualified pension, profit-sharing, or stock-bonus plan described in section 401(a) (including a 401(k) plan)

-

An annuity plan described in section 403(a)

-

An annuity contract or custodial account described in section 403(b)

-

A simplified employee pension (SEP) plan described in section 408(k)

-

A SIMPLE retirement account described in section 408(p)

-

A trust described in section 501(c)(18)

-

A plan for federal, state, or local government employees or by an agency or instrumentality thereof (other than a section 457(b) plan)

Group-term life insurance

If you paid for group-term life insurance over $50,000 for an employee or a former employee, you must report the taxable cost of excess coverage, determined by using the table in section 2 of Pub. 15-B, in boxes 1, 3, and 5 of Form W-2. Also, show the amount in box 12 with code C.

For employees, you must withhold Social Security and Medicare taxes, but not federal income tax. Former employees must pay the employee part of Social Security and Medicare taxes on the taxable cost of group-term life insurance over $50,000 on Form 1040. You are not required to collect those taxes. However, you must report the uncollected Social Security tax with code M and the uncollected Medicare tax with code N in box 12 of Form W-2.

S-Corporation shareholder accident/health insurance premiums

The total of health, dental, life and disability insurance payments paid by an S-Corporation for shareholders who own greater than 2% of the outstanding stock should be reported on the shareholders’ W-2s in boxes 1 and 16 (if applicable) along with their regular wages. These fringe benefits are not subject to Social Security, Medicare or federal unemployment taxes and therefore should not be included in Boxes 3 and 5 of the W-2.

Third-Party Sick Pay

In general, sick pay is any amount you pay under a plan to an employee who is unable to work because of sickness or injury. These amounts are sometimes paid by a third party, such as an insurance company or an employees' trust. In either case, these payments are subject to Social Security, Medicare, and FUTA taxes. Sick pay becomes exempt from these taxes after the end of 6 calendar months after the calendar month the employee last worked for the employer. The payments are always subject to federal income tax. See Publication 15-A for more information.

Employee Reimbursements

A reimbursement or allowance arrangement is a system by which you pay the advances, reimbursements, and charges for your employees' business expenses. How you report a reimbursement or allowance amount depends on whether you have an accountable or a non-accountable plan. If a single payment includes both wages and an expense reimbursement, you must specify the amount of the reimbursement. These rules apply to all ordinary and necessary employee business expenses that would otherwise qualify for a deduction by the employee.

Accountable plan. To be an accountable plan, your reimbursement or allowance arrangement must require your employees to meet all three of the following rules.

-

They must have paid or incurred deductible expenses while performing services as your employees. The reimbursement or advance must be paid for the expense and must not be an amount that would have otherwise been paid by the employee.

-

They must substantiate these expenses to you within a reasonable period of time.

-

They must return any amounts in excess of substantiated expenses within a reasonable period of time.

Amounts paid under an accountable plan are not wages and are not subject to the withholding and payment of income, Social Security, Medicare, and federal unemployment (FUTA) taxes. If the expenses covered by this arrangement are not substantiated (or amounts in excess of substantiated expenses are not returned within a reasonable period of time), the amount paid under the arrangement in excess of the substantiated expenses is treated as paid under a non-accountable plan.

This amount is subject to the withholding and payment of income, Social Security, Medicare, and FUTA taxes for the first payroll period following the end of the reasonable period of time. A reasonable period of time depends on the facts and circumstances. Generally, it is considered reasonable if your employees receive their advance within 30 days of the time they incur the expenses, adequately account for the expenses within 60 days after the expenses were paid or incurred, and return any amounts in excess of expenses within 120 days after the expenses were paid or incurred. Also, it is considered reasonable if you give your employees a periodic statement (at least quarterly) that asks them to either return or adequately account for outstanding amounts and they do so within 120 days.

Non-accountable plan. Payments to your employee for travel and other necessary expenses of your business under a non-accountable plan are wages and are treated as supplemental wages and subject to the withholding and payment of income, Social Security, Medicare, and FUTA taxes. Your payments are treated as paid under a non-accountable plan if:

-

Your employee is not required to or does not substantiate timely those expenses to you with receipts or other documentation

-

You advance an amount to your employee for business expenses and your employee is not required to or does not return timely any amount he or she does not use for business expenses, or

-

You advance or pay an amount to your employee regardless of whether you reasonably expect the employee to have business expenses related to your business

-

You pay an amount as a reimbursement you would have otherwise paid as wages

Per diem or other fixed allowance. You may reimburse your employees by travel days, miles, or some other fixed allowance under the applicable revenue procedure. In these cases, your employee is considered to have accounted to you if your reimbursement does not exceed rates established by the Federal Government. The 2022 standard mileage rate for auto expenses is $0.585 per mile. The government per diem rates for meals and lodging in the continental United States are listed in Publication 1542, Per Diem Rates. Other than the amount of these expenses, your employees' business expenses must be substantiated (for example, the business purpose of the travel or the number of business miles driven).

If the per diem or allowance paid exceeds the amounts specified, you must report the excess amount as wages. This excess amount is subject to income tax withholding and payment of Social Security, Medicare, and FUTA taxes. Show the amount equal to the specified amount (for example, the nontaxable portion) in box 12 of Form W-2 using code L.

Wages not paid in money. If in the course of your trade or business you pay your employees in a medium that is neither cash nor a readily negotiable instrument, such as a check, you are said to pay them “in kind.” Payments in kind may be in the form of goods, lodging, food, clothing, or services. Generally, the fair market value of such payments at the time they are provided is subject to federal income tax withholding and Social Security, Medicare, and FUTA taxes.

Business Vehicles

You may choose not to withhold income tax on the value of an employee's personal use of a vehicle you provide. You must, however, withhold Social Security and Medicare taxes on the use of the vehicle. See Publication 15-B for more information on this election.

Vehicle allocation rules. If you provide a car for an employee's use, the amount you can exclude as a working condition benefit is the amount that would be allowable as a deductible business expense if the employee paid for its use. If the employee uses the car for both business and personal use, the value of the working condition benefit is the part determined to be for business use of the vehicle. See Business use of your car under Personal versus Business Expenses in chapter 1 of Publication 535. Also, see the special rules for certain demonstrator cars and qualified non-personal-use vehicles discussed below.

However, instead of excluding the value of the working condition benefit, you can include the entire annual lease value of the car in the employee's wages. The employee can then claim any deductible business expense for the car as an itemized deduction on his or her personal income tax return. This option is available only if using the lease value rule to value the benefit.

If you provided your employee a vehicle and included 100% of its annual lease value in the employee's income, you must separately report this value to the employee in box 14 (or on a separate statement). The employee can then figure the value of any business use of the vehicle and report it on Form 2106, Employee Business Expenses. Also see Pub. 15-B for more information

Qualified non-personal-use vehicles. All of an employee's use of a qualified non-personal-use vehicle is a working condition benefit. A qualified non-personal-use vehicle is any vehicle the employee is not likely to use more than minimally for personal purposes because of its design. Qualified non-personal-use vehicles generally include all of the following vehicles.

-

Clearly marked, through painted insignia or words, police and fire vehicles

-

Unmarked vehicles used by law enforcement officers if the use is officially authorized

-

An ambulance or hearse used for its specific purpose

-

Any vehicle designed to carry cargo with a loaded gross vehicle weight over 14,000 pounds

-

Delivery trucks with seating for the driver only, or the driver plus a folding jump seat

-

A passenger bus with a capacity of at least 20 passengers used for its specific purpose

-

School buses

-

Tractors and other special-purpose farm vehicles

The following moving expenses are taxable:

-

Pre-move house-hunting trips

-

Temporary living expenses for 30 days in the general area of the workplace

-

Selling or settling an unexpired lease on the old residence and buying or acquiring a lease on the new address

-

Real estate transactions

-

Any meals connected with the relocation

The only expenses that are still deductible (with no dollar limit on the deduction) are: expenses incurred in moving household goods and personal expenses incurred in traveling (including lodging but not meals) from the old residence to the new residence.

To qualify for these deductions, the distance between the employee’s new workplace and his old residence must be at least 50 miles farther than the distance between the employee’s old workplace and his or her old residence.

Group-Term Life: Employer-Paid Life Insurance

IRC section 79 provides exclusion for the first $50,000 of group-term life insurance coverage provided under a policy carried directly or indirectly by an employer. There are no tax consequences if the total amount of such policies does not exceed $50,000. The imputed cost of coverage in excess of $50,000 must be included in income, using the IRS Premium Table, and is subject to Social Security and Medicare taxes.

Carried Directly or Indirectly by the Employer

A taxable fringe benefit arises if coverage exceeds $50,000 and the policy is considered carried directly or indirectly by the employer. A policy is considered carried directly or indirectly by the employer if:

-

The employer pays any cost of the life insurance, or

-

The employer arranges for the premium payments and the premiums paid by at least one employee subsidize those paid by at least one other employee (the “straddle” rule)

The determination of whether the premium charges straddle the costs is based on the IRS Premium Table rates, not the actual cost. You can view the Premium Table in the group-term life insurance discussion in Publication 15-B.

Because the employer is affecting the premium cost through its subsidizing and/or redistributing role, there is a benefit to employees. This benefit is taxable even if the employees are paying the full cost they are charged. You must calculate the taxable portion of the premiums for coverage that exceeds $50,000.

Coverage for Spouse and Dependents

The cost of employer-provided group-term life insurance on the life of an employee’s spouse or dependent, paid by the employer, is not taxable to the employee if the face amount of the coverage does not exceed $2,000. This coverage is excluded as a de minimis fringe benefit. Whether a benefit provided is considered de minimis depends on all the facts and circumstances. In some cases, an amount greater than $2,000 of coverage could be considered a de minimis benefit. See Notice 89-110 for more information.

Changes to Deferred Compensation / Retirement Plan

Changes to a Deferred Compensation / Retirement plan may affect taxable wages, the calculation of deferrals (based upon earnings that are to be included), and other items. Additionally, match calculations that are processed on a per-pay-period basis. Please review information if you have had these changes so that employee deferrals, employer contributions, and taxes are calculated properly.

Changes to Section 125 / Cafeteria Plan

Changes made to a Section 125 / Cafeteria Plan may affect the taxability of deductions. Please review information if you have had these changes so that employee taxes are calculated properly.

Form W-2 Reporting of Employer-Sponsored Health Coverage

This reporting requirement is effective for Form W-2s that are issued for wages paid in 2022. This informational-only data should include the total cost of the employer-provided coverage, regardless of who is paying the costs. This means both the employee and employer portion of premiums will be included.

Employers who filed fewer than 250 W-2s for the 2021 year are not yet subject to this reporting requirement. This relief remains in effect until further IRS guidance is issued. Such additional guidance will apply prospectively and will not apply to any calendar year beginning within six months of the date the guidance is issued (IRS Notice 2012-9).

Explanation of W-2 Earnings Summary (Please visit irs.gov for a complete listing).

Box 1: Wages, tips, and other compensation. Box 1 reports total taxable wages for federal income tax purposes. This figure includes wages, salary, tips reported, bonuses, and other taxable compensation. Any taxable fringe benefits (such as group term life insurance) are also included in Box 1 wages.

Box 2: Federal income tax withheld. Box 2 reports the total amount withheld from paychecks for federal income taxes. This represents the amount of federal taxes that have been paid-in throughout the year.

Box 3: Social Security wages. Box 3 reports the total amount of wages subject to the Social Security tax.

Box 4: Social Security tax withheld. Box 4 reports the total amount of Social Security taxes withheld from paychecks.

Box 5: Medicare wages and tips. Box 5 reports the amount of wages subject to Medicare taxes. There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1. Medicare wages includes any deferred compensation, 401(k) contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents the entire compensation.

Box 6: Medicare tax withheld. Box 6 reports the amount of taxes withheld from paycheck for the Medicare tax.

Box 7: Social Security tips. Box 7 reports the amount of tip income reported to the employer. If tips are not reported to the employer, an amount will not be in this box. The amounts in Box 7 and Box 3 should add up to the amount in Box 1, or the maximum wage limit for Social Security taxes.

Box 8: Allocated tips. Box 8 reports any tip income that an employer thinks an employee may have earned, but failed to report. This amount is not included in the wages reported in Boxes 1, 3, 5, or 7.

Box 10: Dependent Care Benefits. Box 10 reports any amounts reimbursed for dependent care expenses, or the dollar value of dependent care services provided by your employer. Amounts under $5,000 are non-taxable benefits. Any amount over $5,000 is reported as taxable wages in Boxes 1, 3, and 5. Non-taxable benefits must be excluded from expenses claimed for the child and dependent care tax credit on IRS Form 2441.

Box 11: Nonqualified Plans. Box 11 reports any amounts distributed to an employee from the employer's non-qualified deferred compensation plan or non-government Section 457 pension plan. The amount in Box 11 is already included as taxable wages in Box 1.

Box 12: Deferred Compensation and Other Compensation. There are several types of compensation and benefits that can be reported in Box 12. Box 12 will report a single letter or double letter code followed by a dollar amount. The following is a list of commonly used codes for Box 12. Please visit irs.gov for a complete listing.

-

Code A – Uncollected Social Security or RRTA tax on tips.

-

Code B – Uncollected Medicare tax on tips.

-

Code C – Taxable benefit of group term-life insurance over $50,000. This amount is already included as part of taxable wages in Boxes 1, 3, and 5.

-

Code D – Non-taxable elective salary deferrals to a 401(k) or SIMPLE 401(k) retirement plan.

-

Code E – Non-taxable elective salary deferrals to a 403(b) retirement plan.

-

Code F – Non-taxable elective salary deferrals to a 408(k)(6) SEP retirement plan.

-

Code G – Non-taxable elective salary deferrals and non-elective employer contributions to a 457(b) retirement plan.

-

Code H – Non-taxable elective salary deferrals to a 501(c)(18)(D) tax-exempt plan.

-

Code J – Non-taxable sick pay. This amount is not included in taxable wages in Boxes 1, 3, or 5.

-

Code W – Employer Contributions to a Health Savings Account (HSA)

-

Code AA – After-tax contributions to a Roth 401(k) retirement plan.

-

Code BB – After-tax contributions to a Roth 403(b) retirement plan.

-

Code DD – Reports the cost of health insurance provided through the employer.

-

Code EE – After-tax contributions to a Roth 457(b) retirement plan offered by government employers.

-

Code FF – Qualified small employer health reimbursement arrangement.

Box 13: Check the Box. There are three check boxes in Box 13. Boxes will be checked off if any of these situations apply to an employee.

Statutory employee means that an employee must report the wages from this W-2 (and any other W-2 forms marked "statutory employee") on Form 1040 Schedule C. Wages are not subject to income tax withholding (there will be a zero or blank amount in Box 2), but are subject to Social Security and Medicare taxes (Boxes 3 through 6).

Retirement plan means that an employee participated in the employer's retirement plan during the year. This could include a 401(k) plan, profit-sharing plan, or pension plan.

Third-party sick paymeans that the employee received sick pay under the employer's third-party insurance policy. (Instead of receiving sick pay directly from the employer as part of a regular paycheck.) Sick pay is not included in taxable wages.

Box 14: Other Tax Information. Employers may report additional tax information in Box 14. If any amounts are reported, they will have a brief description of what the amounts are for. For example, gross wages, union dues, employer-paid tuition assistance, or after-tax contributions to a retirement plan will be reported here. Some employers report certain state and local taxes in Box 14, such as State Disability Insurance (SDI) premiums.

W-2 Address Verification

It is VERY IMPORTANT to submit your W2 shipping address by 12/30/2022 to avoid W-2 shipment delays. This is the address that will be used to ship W-2 forms. NOTE: Our carriers will not ship to PO Boxes. Use this link https://forms.office.com/r/sGZTYNwur8to submit this information electronically.

Preparing for 2023

TO DO CHECKLIST for the New Year review:

-

Verify the amount of unemployment tax rates and associated wage limits.

-

Determine whether a voluntary unemployment contribution should be made to reduce the upcoming unemployment tax rate for the new year.

-

Notify employees to review their W-4 forms. Update employee withholdings based on revised W-4 forms.

-

Notify employees of unused flexible spending account deductions.

REPORT CHANGES between now and the end of January for notices such as:

-

Deposit Frequency- as payroll taxes grow, tax frequencies can change

-

Rate Changes – typically employers receive notice of new unemployment tax rates

-

Additional States or Localities – provide us any new ID numbers immediately

Please submit tax agency correspondence as soon as notifications are received to CertiPay as soon as possible.