Employee & Employer Health Plan Contributions

Health Plan Premium (Pre-tax) is used to record employee health insurance deductions and is deducted on a pre-tax basis. If you elected to cover a portion of your employees' healthcare costs, Employer Contribution amounts can be added via the deduction section of your employee's profile.

Employer contributions are shown under "Benefits" on pay stubs and are reflected in Box 12 Code DD of your employee's W-2.

Add Healthcare Contributions by choosing the option that works best for you:

If the employee needs employee and/or employer Health Plan Premium (Pre-Tax) contributions added to his/her profile:

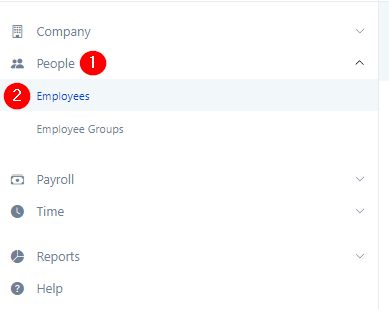

1. Go to People in the left navigation bar then Employees

2. Select the employee you would like to update

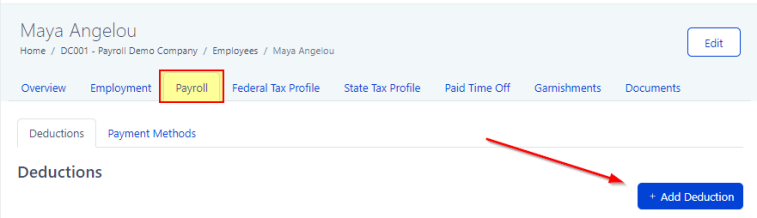

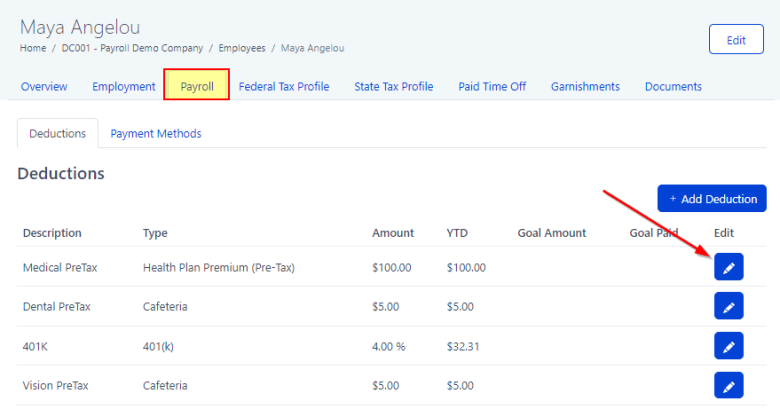

3. Choose Payroll from the employee's menu bar

4. Under Deductions, click on the blue Add Deduction button

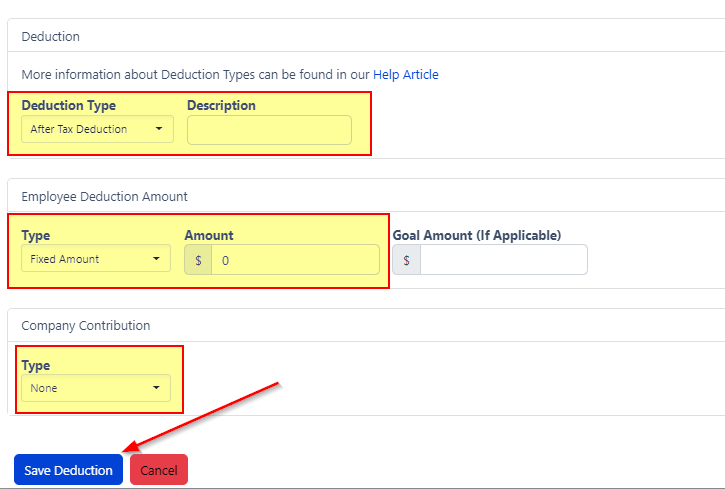

5. Select the Deduction Type from the drop-down menu and enter a description

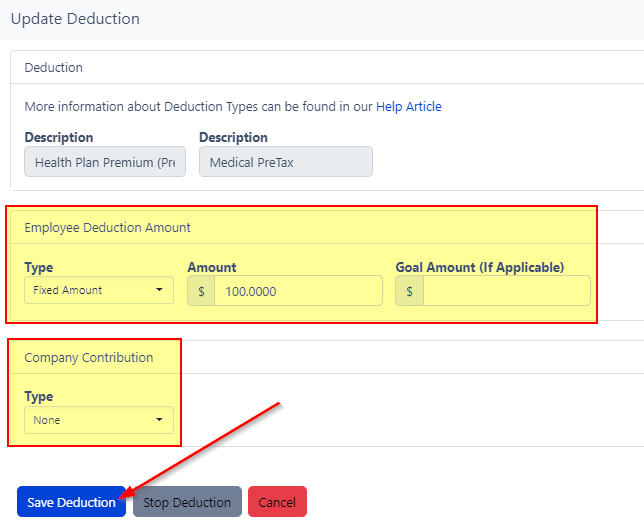

6. Add the amounts for Employee Deduction Amount and Company Contribution per pay period*

7. Save Deduction

If the employee already has a Health Plan Premium (Pre-Tax) deduction on his/her profile but the Employer Contribution needs to be added:

1. Go to People in the left navigation bar then click Employees

2. Select the employee you would like to update

3. Choose Payroll from the employee's menu bar

4. Under Deductions, click on Edit Deduction to the right of the deduction you would like to edit

5. Update the amounts for Employee Deduction Amount and Company Contribution per pay period as needed*

6. Save Deduction

*If applicable, Employee Deduction Amount can be set as $0 (Employer pays for this benefit). Company Contribution amount can be left blank or set as $0 (Employee pays for this benefit).

Please note that CertiPay Online does not make payments to healthcare insurance providers. Any employee healthcare deductions remain in the company account and are the responsibility of the client.